WATCH ANALYTICS WEDNESDAYS: New Rolex price hikes, which models were the most affected?

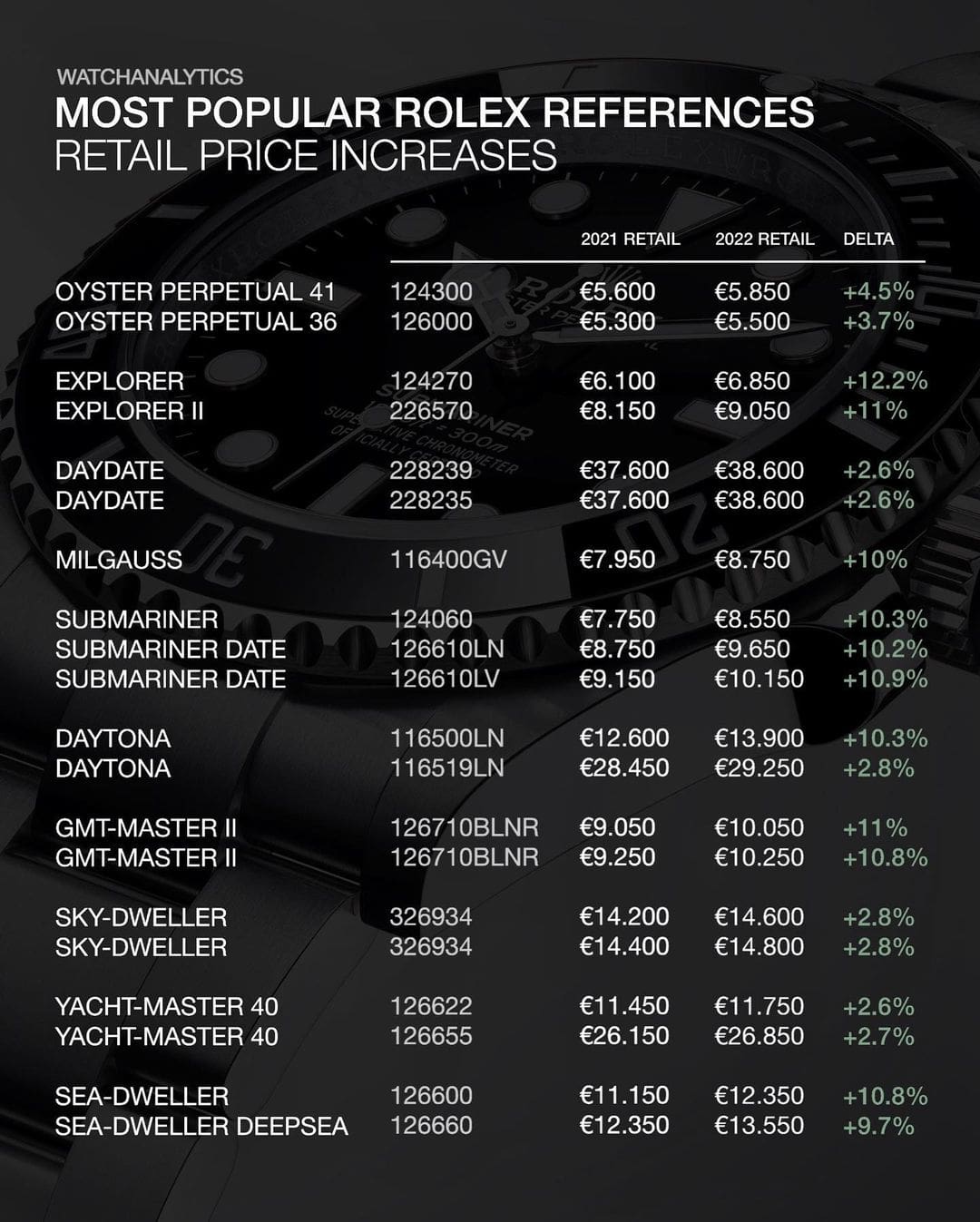

Zach BlassEditor’s Note: In a new series for Time+Tide, we recently partnered with @watchanalytics to crunch the numbers and dig into the horological market trends and value fluctuations for the references that matter. Last time, we delved into the Rolex Oyster Perpetual Turquoise and its value spike in the wake of the record-breaking Patek Phillipe Nautilus 5711/1A-018 “Tiffany Blue” auction sale. Today we are going to dive into the 2022 Rolex price hikes and discover which models were the least and most affected.

View this post on Instagram

Annual price hikes are not uncommon. Many, if not all, brands engage in the practice to adjust for inflation at the very. The same way Rolex is known for incremental change in their designs, they are also known to bump prices up in small increments as well – usually by 3% each year. But as @watchanalytics revealed in a recent post, the price increases introduced in 2022 were by no means uniform.

The market analysis

The conducted analysis, performed in euros, reveals price increases from 2.6% to 12.2% – making the model, in steel, with the lowest price increase the Yacht-Master 40 while the Explorer was the greatest. While the Oyster Perpetual is the gateway reference into the catalogue, with the most approachable retail pricing of all Rolex references, the Explorer has been the entry-level model for the “professional” references which include the Submariner, Daytona, Explorer II, GMT-Master II, Sea-Dweller, Yacht-Master, Milgauss, and Air-King.

The other side of the Rolex catalogue coin is referred to as their “classic” watches: Datejust, Oyster Perpetual, Cellini, Lady-Datejust, Pearlmaster and Sky-Dweller. Why am I bothering to emphasise this classification? Well, it is clear from the data the “classic” models had the smallest price increasse, hovering closer to 3%, while, for the most part, the “professional” references had the greatest increases hovering around 10%.

The takeaways

To boil down the aforementioned increases to “hype” or “steel sports demand” would be understandable as an immediate reaction, but the numbers reveal it is not so simple. Arguably the hype beast of the Rolex catalogue today is the Rolex Oyster Perpetual 41 Turquoise, and yet it was far from being the model with the heftiest price increase. Clearly, even if they remain elusive in AD cases, Rolex feels the Oyster Perpetual range must remain as the symbolic entry-level design of the brand. To hike its pricing above the Datejust for example would cause confusion and incite a bit of an identity crisis within the catalogue.

Models such as the Sky-Dweller and Yacht-Master also escaped the 10% increase of many of the popular steel references in the catalogue, jumping less than 3%. I would love to be a fly on the wall in the Rolex boardroom where these increases were decided, because without being present in the room there is no way to know for sure what the exact logic was. The way I see it, perhaps Rolex felt the current pricing reflected what the market would safely digest and therefore defaulted to what I associate as the “inflation percentage”.

To say the Sky-Dweller and Yacht-Master are not in-demand models would be quite inaccurate – try buying one at your local AD if you don’t believe me. But it is also fair to say that the models that did receive around 10% or more of an increase in pricing are the more iconic and established models within the stainless-steel pantheon of Rolex. The Sky-Dweller and Yacht-Master don’t have the same storied history as references like the Submariner or GMT Master II, yet they are also higher in retail price than the historic pair. The Sky-Dweller is more palatable at its greater price point, as it is the most complicated Rolex watch in the modern collection. The Yacht-Master in steel, on the other hand, has a higher price than a Submariner due to its entirely platinum bezel. But is an entirely platinum bezel really a selling point in today’s marketplace? If yes, more-so than the rich heritage and greater aquatic performance capability of a Submariner? This, in effect, creates a new equilibrium within the catalogue. A fiscal acknowledgement of what the market really prizes most.

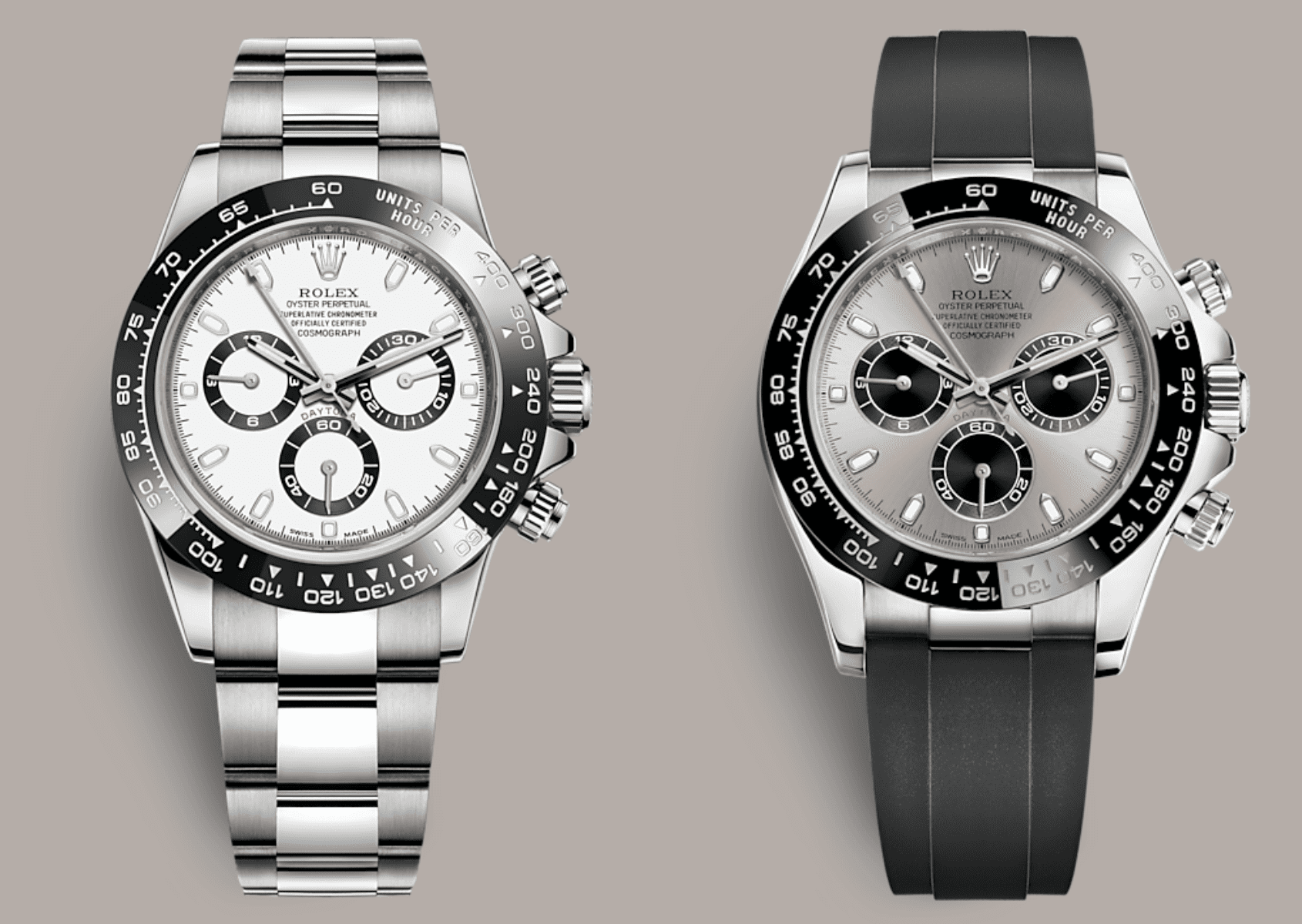

Lastly, while it pains me to write this, if you enjoy Rolex as a brand due to its investment potential then you are going to want to focus on “professional” references in stainless steel. Precious metal “classics” like the Day-Date, and even the “professional” Daytona 116519LN in white gold on Oysterflex had among the lowest price increases across the board of the analysed references. While it is by no means the primary driver of secondary price – as clearly exhibited by the Oyster Perpetual Turquoise – greater price jump potential at retail ensures reliable and steady increases. If demand crashes for the Oyster Perpetual Turquoise, the secondary value would theoretically decline closer towards its retail pricing. But, anyone who owns a “professional” steel sports reference, other than the Yacht-Master, effectively just gained a 10% bump in trading value. If retail goes up, the secondary market adjusts to account for it – and it is always safer when numbers drive other numbers rather than a “hype economy”.