WATCH ANALYTICS WEDNESDAYS: How the Tiffany Blue Nautilus affected the Rolex OP Turquoise price

Zach BlassEditor’s Note: In a new series for Time+Tide, we have partnered with @watchanalytics to crunch the numbers and dig into the horological market trends and value fluctuations for the references that matter. To kick things off, we are going to dive into the Tiffany Blue Nautilus, and how its sale at auction has impacted the Rolex Oyster Perpetual Turquoise.

The label of “entry-level” is a bit ironic for any in-demand brand reference as you may have seen from the reaction to a Hodinkee story regarding the “entry-level” Patek Philippe Aquanaut. Even if totally accurate on paper, the label will inevitably cause a digital uproar if the watch in question is not as available as the market would like. This is very much the case with the “entry level” Rolex: the Oyster Perpetual. When it first launched, many naively believed it would be a colourful gateway for more consumers to own a steel reference from the crown. But from the outset, many of the colourways have been just as illusive as some of their more iconic professional references – i.e the Rolex Submariner.

It was only within the last month or so, years after its initial launch, that the modern Rolex Daytona in steel with a ceramic bezel reached the point of selling for three times over retail. The Rolex Oyster Perpetual Turquoise, however, achieved such a feat within a year of its launch. Understandably, this left many watch buyers feeling bummed – a clear sign that this reference and its Tiffany blue like dial fell insides the unobtanium bracket at retail. To own one instantly you will have to cough up a premium, but as we have seen, thanks to recent data provided by @watchanalytics, in the wake of the 5711/1A-018 sale at Phillips that premium is now exponentially growing.

The market analysis

View this post on Instagram

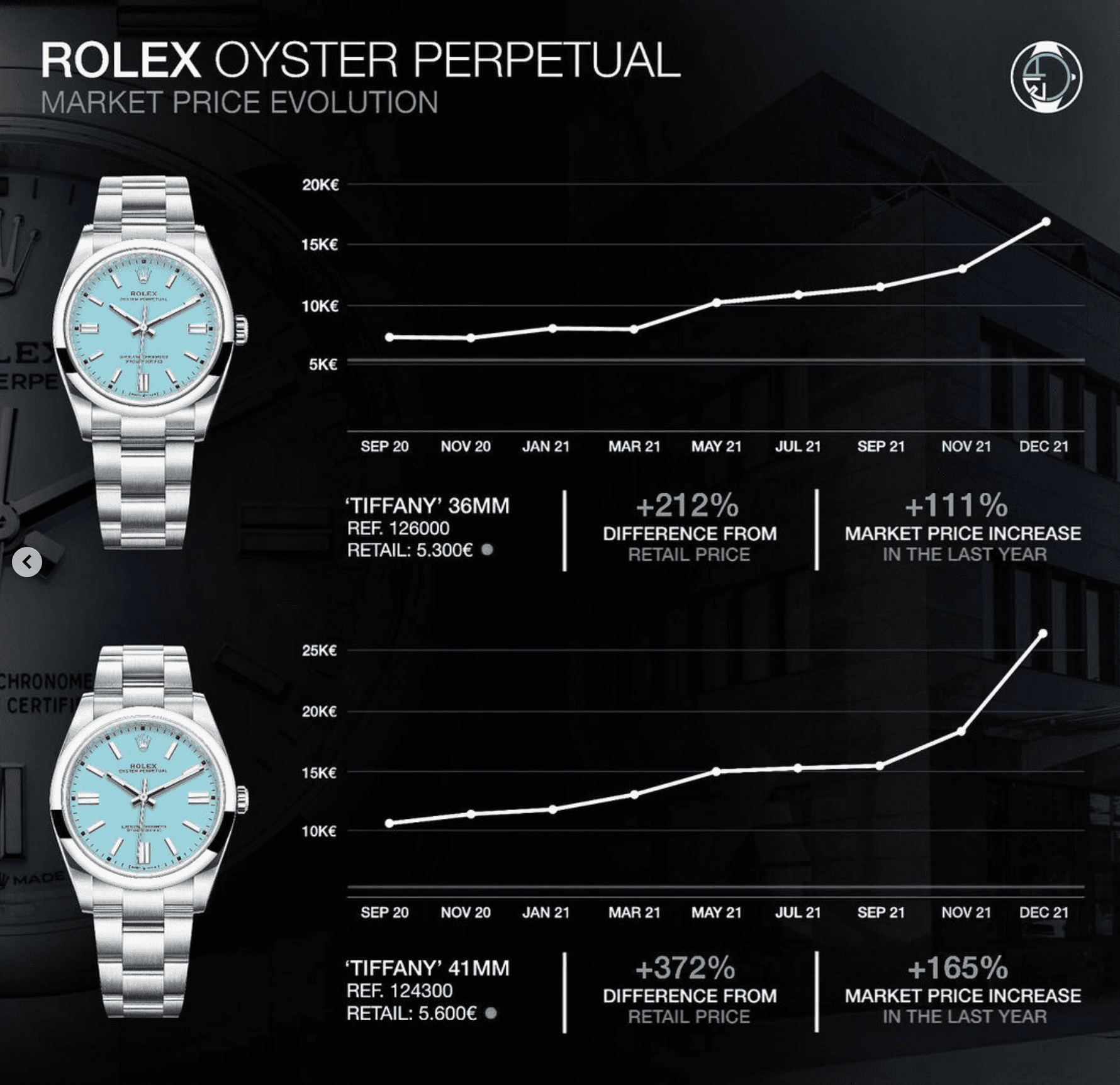

If you click or tap to the right arrow to head to the next image on the embedded post, you will find a chart that details the rise in price for both the Rolex Oyster Perpetual 36 and 41 in turquoise. Leading up to March 2021, the OP Turquoise 41 had steady growth while the 36 remained at a relative standstill. After March 2021, however, both models began to show greater signs of growth. This, perhaps, could be due to the timing of Watches & Wonders – consumers waiting to see what would be introduced before chasing an Oyster Perpetual over retail price on the secondary market.

Where we see each of the turquoise models, both the 36 and 41, have the greatest rate of increase is after November 2021. This can really only be attributed to the announcement of the Tiffany blue 5711/1A-018 Nautilus farewell on December 6, and its sale at the Phillips auction on December 12 for $6.5m USD. Whether this interest was from consumers or grey market flippers, clearly demand surged for the Oyster Perpetual in its turquoise hue with many either more attracted to the colour or its potential value in the wake of the record-breaking sale. The growth, however, was far greater for the OP 41 at 372% difference from retail price and 165% increase in market price from last year, with the 36 now standing at a 212% difference from its retail price and a 111% increase in market value from last year.

The takeaways

So what do we make of all of this? Well I have two key takeaways. Firstly, while more people are joining the campaign to return to more classic diameters, there is still time to get ahead of the curve. If your sweet spot is 38mm, you can find more value or less costly premiums by jumping a few millimetres down instead of up. Secondly, watches that strike a similar chord to a watch that stuns the world at auction will likely have an increase in value as well – riding the wave of its more prestigious counterpart. While not a 1:1 example, the Gevril Tribeca massively increased in value in the wake of the Paul Newman Daytona sale – making it one of, if not the most, valuable homage watches in the world today. All things considered, while many brands already produce a watch with a dial in this attractive shade of blue, it is a safe bet more brands will want to ride this wave as well. The numbers don’t lie, people are keen to get some Tiffany blue on their wrists.