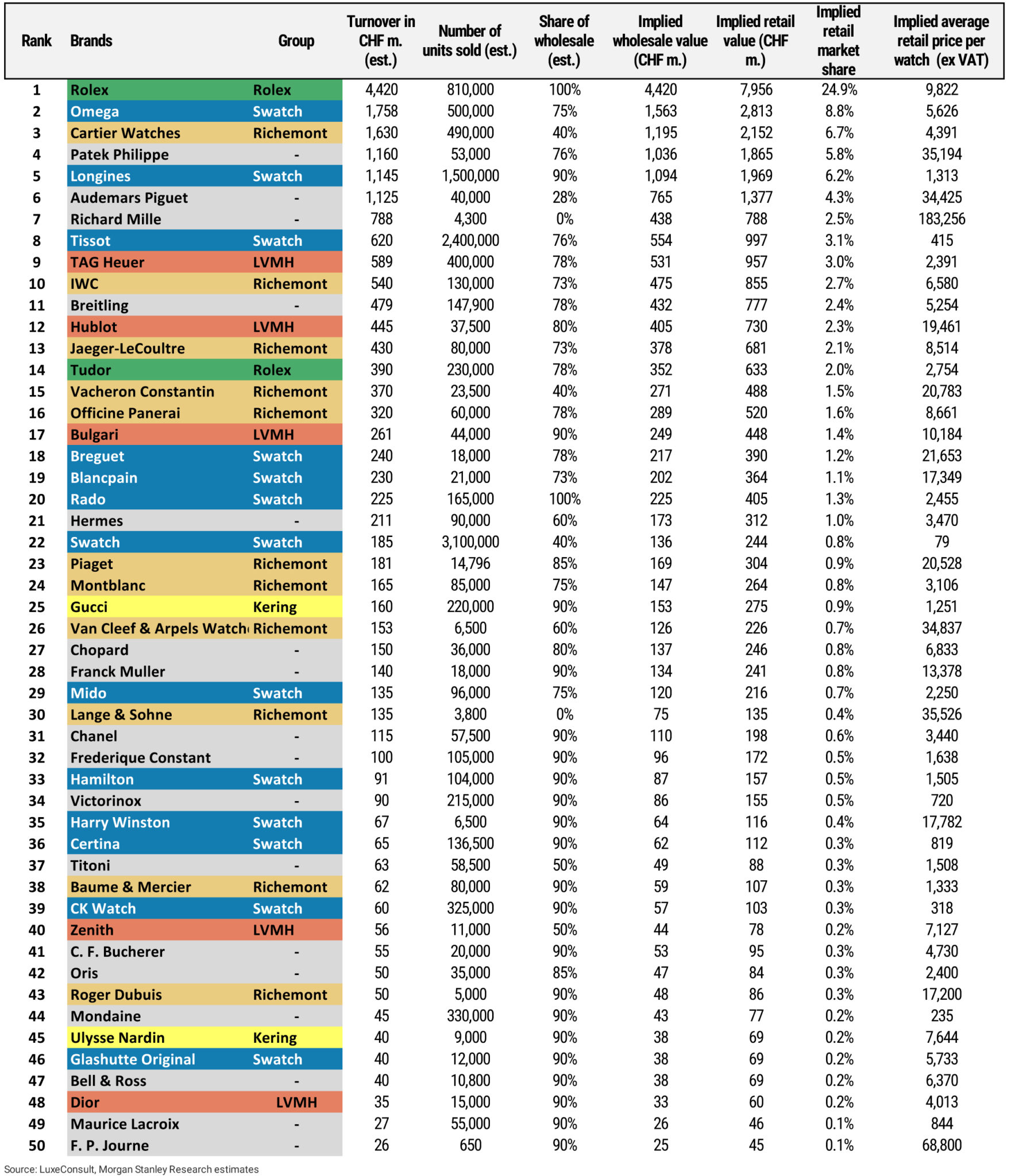

Watch brand league table: Rolex is now 25% of the entire Swiss watch industry, here are the other pandemic movers

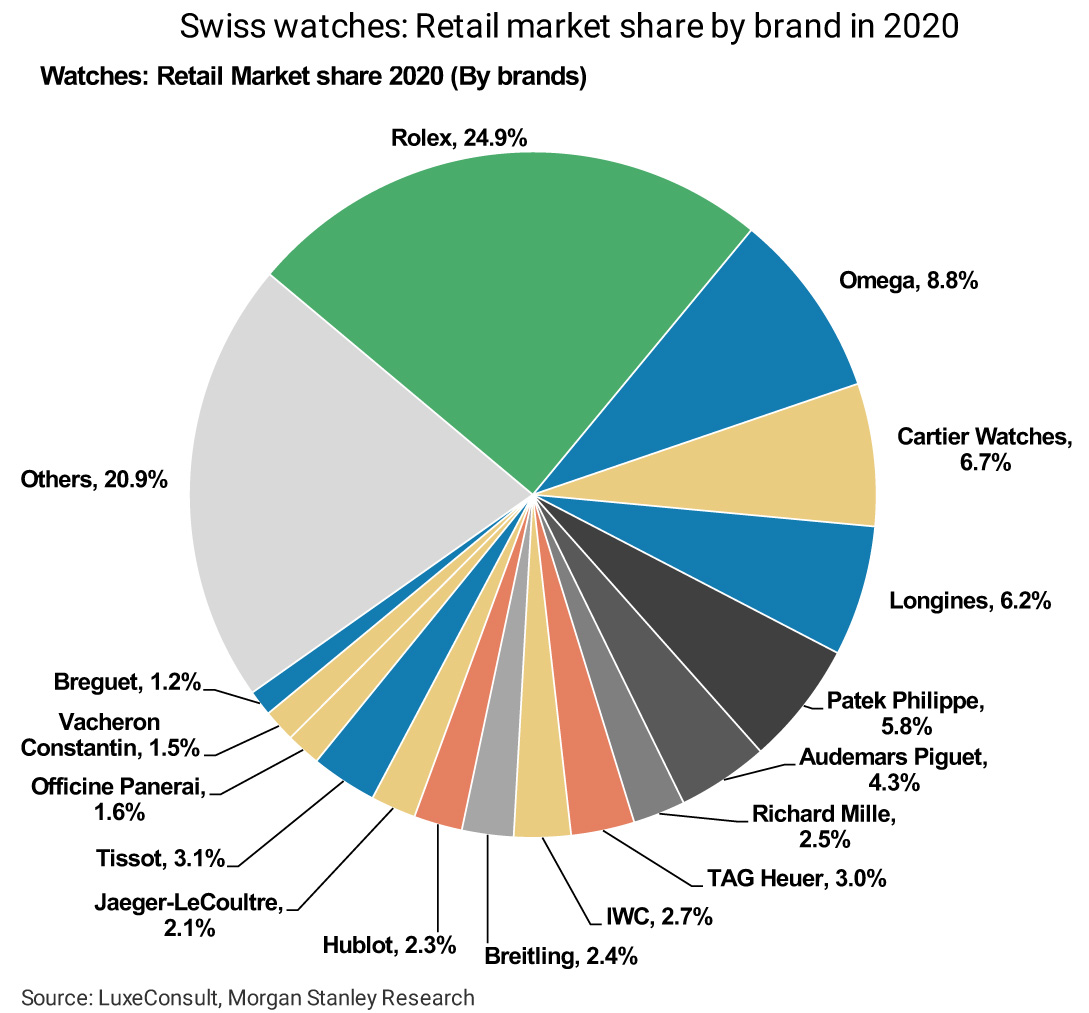

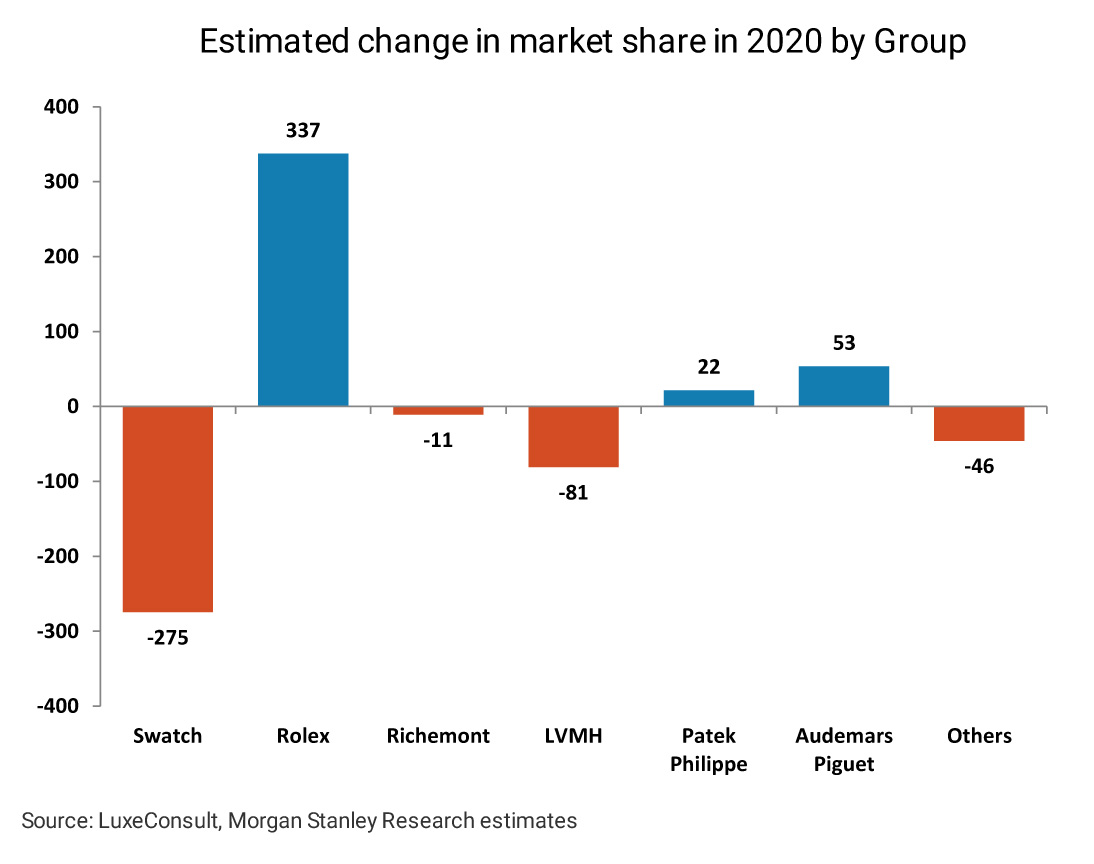

Nick KenyonRolex is the biggest watch brand in the world (so long as you don’t count Apple). But while that information might not come as a surprise, Rolex has actually grown its market share in 2020 despite selling an estimated 140,000 fewer watches than the year before (due to factory closures as a result of the pandemic). This is according to a report by Morgan Stanley that stated Rolex has consolidated its lead at the top during the pandemic, increasing its market share to 24.9% in 2020, up from 22% in 2019.

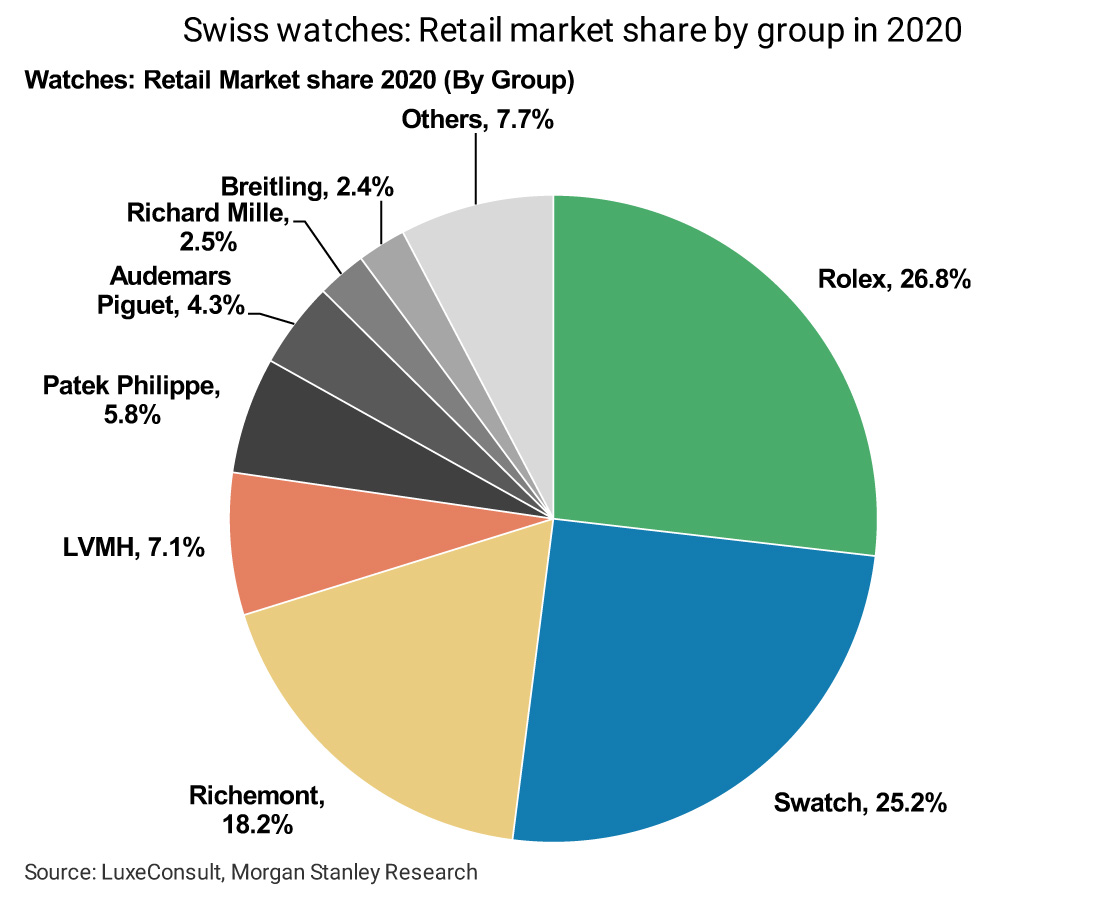

What is also remarkable is that Rolex SA, who also owns Tudor, has become the largest watch manufacturing group on the planet by claiming 26.8% of the market, beating Swatch Group who captured 25.2%.

This growth in market share was in the face of a drop in turnover of 14% from CHF5.05 billion down to CHF4.42 billion, a fall that was softened by a 5% price increase across their range.

In contrast, the latest data from the Federation Horlogère Suisse (FHS) industry body painted a grim picture across the rest of the industry, with a drop in export value of Swiss watches by 21.8% and the number of watches exported dropping by a full 30% (down to 5,480,878). This was the worst fall since the 2008 Global Financial Crisis when the industry saw export value plummet -22.3%.

Behind Rolex on the leaderboard was Omega, who made retail sales of CHF2.8 billion from 500,000 watches sold, and Cartier who significantly increased the volume of watches sold with 410,000 in 2019 to 490,000 in 2020, but the average sale price dropped by 30%.

The industry certainly isn’t out of the woods yet with the FHS reporting that Swiss watch exports dropped -2.5% in December and -11% in January. But hope might be found in the Chinese market, which grew +45.2% in December and performed even better in January growing +58.2%.