Top Swiss watch CEOs tell Fortune they’ve been too “arrogant” as the pandemic watch boom peters out

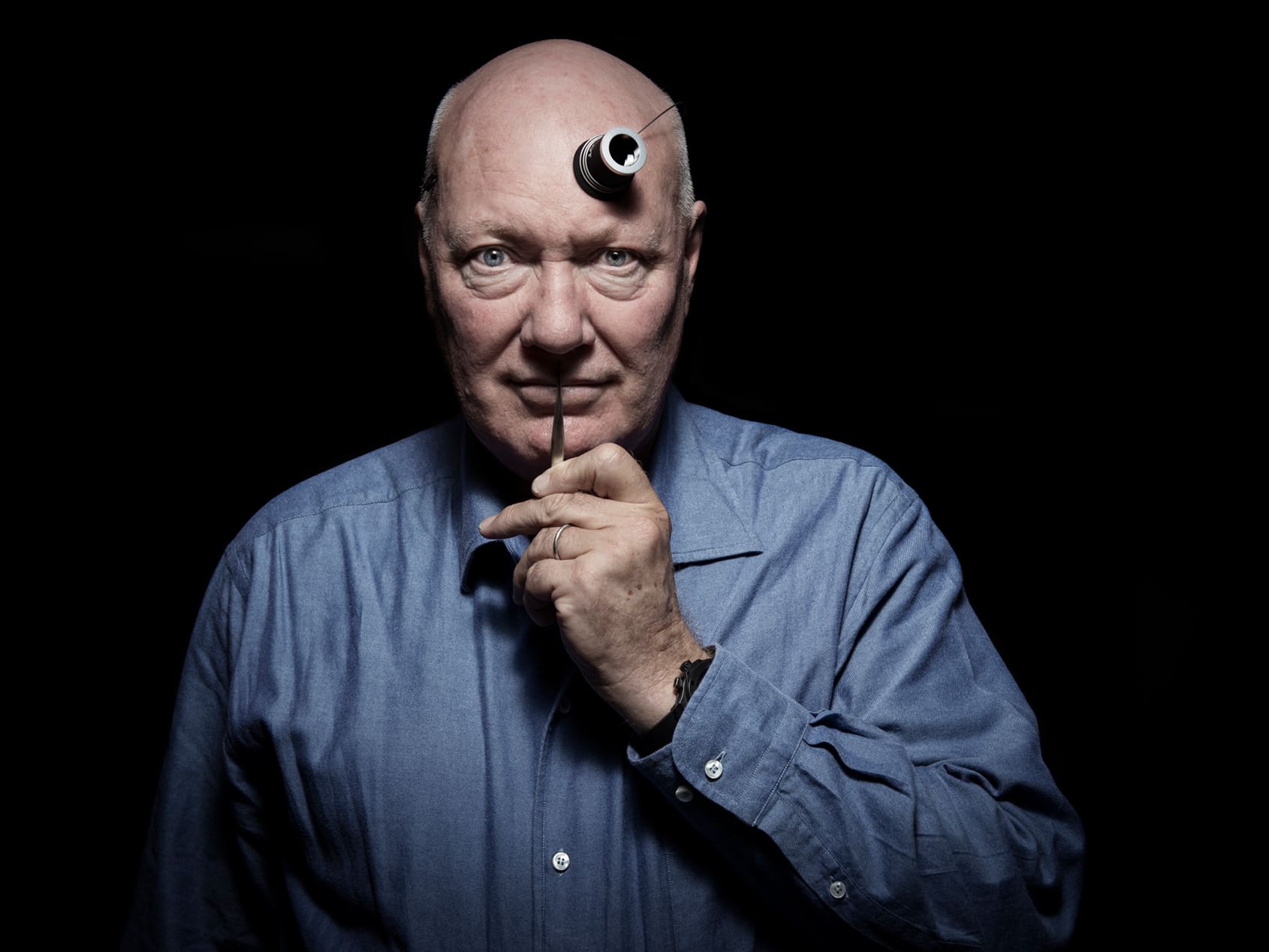

Jamie WeissMost industries did it tough during the COVID-19 pandemic, but in my mind, there have been two big winners: supermarkets (why are Pringles now $5 a can?) and the luxury watch industry. Back in 2020, it looked like the watch industry was likely to be hit harder than most industries, with the pandemic shutting down factories, furloughing hard-to-replace watchmakers and boutiques shutting shop across the globe. However, a few notable industry figures, like the ever-sage Jean-Claude Biver, predicted that the watch world would rebound quickly – and he was right.

Indeed, The Spicy Cough led to an unprecedented boom for the watch industry. With international travel off the cards, the well-heeled of the world instead chose to pour their money into collecting watches. “For three years, the industry enjoyed a surge of renewed interest that kicked off during the pandemic, when wealthy – and cash-flush – consumers stuck at home began drooling over luxury mechanical wristwear from iconic Swiss brands,” Fortune explains.

They also point out that 2022 saw Swiss watch exports rise to a record US$28.5 billion – but now we’re due for a reckoning as the post-pandemic era sets in and demand for watches is cooling off. Higher interest rates, an unstable economy and an unstable world all have their role, but the reason this Fortune article is so worth reading is it points to another issue that’s beguiling the luxury watch industry: Swiss arrogance.

Fortune points to two factors: the aggressive price hikes some Swiss brands have embarked on over the last 24 months, as well as a glut of stock caused by pandemic-rebound over-production. They specifically point to brands like Rolex, who raised prices twice in 2022 when normally they only raise prices once a year; the Swatch Group’s Omega, Longines and Tissot and Richemont’s A. Lange & Söhne and Jaeger-LeCoultre as some of the brands who’ve been marking their prices up dramatically.

Indeed, the feeling I’ve got from many of my fellow watch enthusiasts lately is that the brazen price-hiking that big-name brands like IWC, Omega and Rolex have embarked on lately has left a bad taste in many collectors’ mouths. Perhaps that’s why independents and microbrands are having such a moment right now… But I digress.

Fortune also managed to nab some choice quotes from some of Switzerland’s top watch bosses, such as Oris co-CEO Rolf Studer who explains that “There’s a lot of watches in the market right now… Consumers are having other issues or finding other ways to spend their money so there is a lot of stock everywhere that must be eaten somewhere by somebody.” Norqain CEO Ben Küffer adds his voice to the chorus, explaining that “September and October [2023] have been tough,’’ pointing to the Hamas-Israel war as contributing to the shift in consumer sentiment.

The overall message is that perhaps Switzerland’s watchmakers were living off the fat of the land during the pandemic, and are now being forced to switch gears. Outgoing Audemars Piguet CEO François-Henry Bennahmias is quoted as saying “What we saw in 2021 and 2022 was out of the norm,” concerning the watch industry boom. “We couldn’t even fathom that we would experience this in our lives. I believe that we will never see this ever again,” he reckons.

As per usual, Biver has the last and most salient word, explaining that “the Swiss always end up producing too many watches even when demand slows down,” adding: “We should have learned and still we haven’t yet learned because we don’t have sufficient modesty. We are a little bit arrogant. We feel that we are the king of the customer – and it’s the customer who is the king. You should never reverse this.” Biver knows a thing or two about what watch customers want, so this is a take worth paying attention to. Read the full Fortune article here.