AGREE OR DISAGREE: Rolex prices will one day be at or under retail – these were your responses…

Zach BlassAt the top of the list of brands associated with the unobtanium phenomenon is Rolex. Yes, other brands have this shared insufferable quality of low access to watches at retail, but, these other brands are independents with much smaller production runs. Rolex makes approximately 800,000 to a million watches annually, yet many consumers leave boutiques disappointed when they find out that they can not purchase their desired Rolex model. Such high demand, beyond even their large production scale, has meant that for many years, Rolex has carried hefty premiums on the secondary market. This subject is widely discussed within the watch community, but we recently took to Instagram to ask you all if you believe secondary Rolex prices will one day return to retail or even under retail. With nearly 200 responses to the post in just a few days, it was clear that there were three schools of thought in answering this prompt. These were your responses…

View this post on Instagram

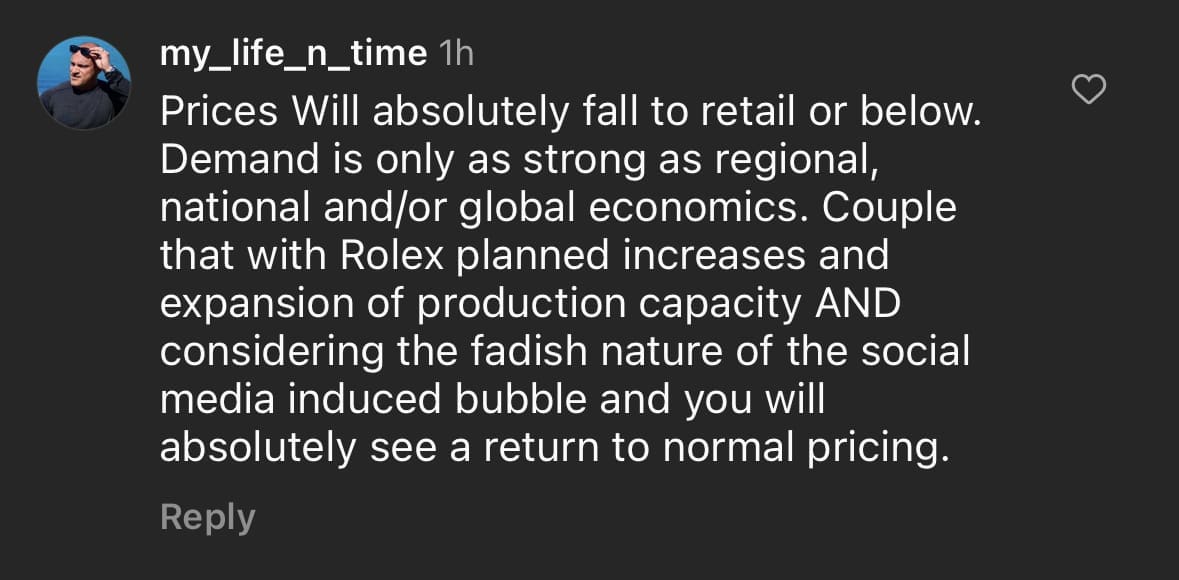

The case for “agree”

While I perhaps am more sceptical and pessimistic in this regard, to my surprise many in the comments suggested it is only a matter of time. One of the more eloquent responses in favour of “agree” was @my_life_n_time who cited a few factors in support of his claim. These factors include a potentially incoming recession in the stock market, Rolex building a new facility which should hypothetically increase production, and the ever-changing nature of fads. While I do not believe Rolex will ever fall out of fashion, for lack of a better phrase, should the world’s consumers be heading into a period of less expendable cash and increased Rolex production, a case could be made for Rolex secondary pricing to take a noticeable dip.

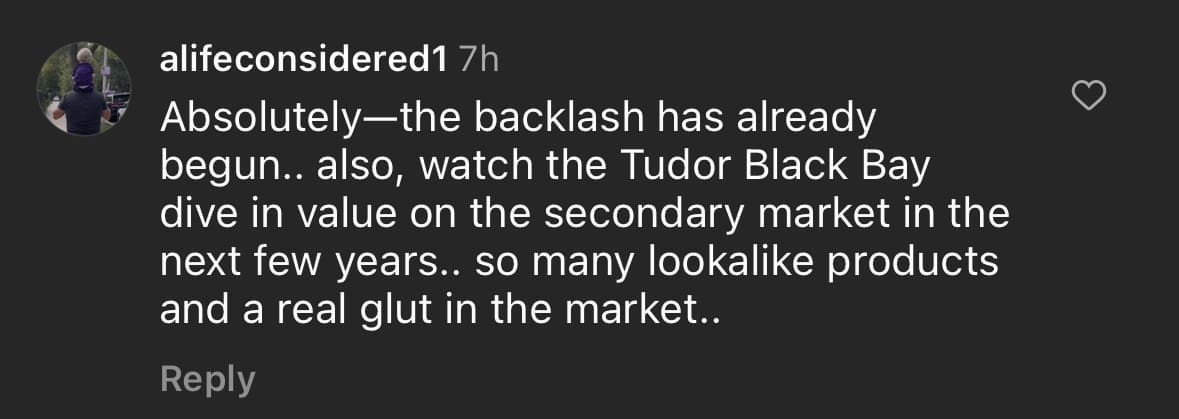

Other arguments cited the watch community’s widespread frustration with Rolex games at retail, and an increase in awareness towards other brands and suitable alternatives. This is certainly a shift we are seeing, with a more educated consumer base losing patience and seeing equal or greater value in offerings from other brands. While the base is growing, it is still indicative of the niche, and does not factor in the behemoth Rolex represents within the mainstream as a status symbol. That being said, should awareness and perception shift towards Tudor, whose Black Bay is inching closer and closer to near-Submariner quality, brands with high quality and aesthetically similar watches will potentially poach those frustrated with waiting for the likes of a Submariner.

The case for “agree, but only certain models”

As for where I personally land on this topic, I would say my most optimistic response would be within the “agree, but only certain models” sentiment. Many pointed out that there are near-retail Rolex watches on the secondary market at present, but these are models outside of the professional line-up which includes references like the Daytona, GMT-Master II, and Submariner. These hot, stainless steel sports watches are the most sought after, whether as a result of genuine interest or speculators. The ratio of demand versus supply here is the most skewed, with very high demand for professional watches which are the least supplied. Therefore, even if the number of those willing to enter the rat race of acquisition weans, there is the a long way to go until it becomes smaller than the level of supply, and even if supply does inch closer to demand within the professional segment, consumers will have to wait for authorised dealers to give up on playing the VIP allocation game.

Where there is more hope is within the space of classic references like the Oyster Perpetual and Datejust. These less glamorous models, at leasing excluding the still-hot lacquer-coloured Oyster Perpetuals, are not huge performers on the secondary – above retail, but only slightly. The other potential avenue is precious metal models, which, assuming an economic recession happens, are the most vulnerable for losing their waiting queues.

The case for “disagree”

Those proclaiming “disagree”, which I understand, do not see the status quo changing. This stems from the brand power of Rolex, which has never faltered – only grown. With Rolex strategy so strict and precise, their track record has indicated they will always safely protect the status of the brand and its loyal customers.

Those who believe in the idea that Rolex is behind the scarcity of their hot models (a strategic scarcity if you will), believe that Rolex will simply adjust supply to ensure the current model and level of access remains the same. Considering Rolex makes a ton of watches per year, yet also commands one of the largest premiums, is indicative of just how high demand is. The idea that this demand takes such a drastic blow seems unrealistic in the eyes of some, as Rolex has performed only better and better over the last few decades.

Only time will tell, but the debate will surely not end here.