WATCH ANALYTICS WEDNESDAYS: Is the A. Lange & Söhne Datograph seriously undervalued?

Zach BlassEditor’s Note: We recently partnered with @watchanalytics to crunch the numbers and dig into the horological market trends and value fluctuations for the references that matter. Last time, we delved into how Omega Speedmaster Limited Editions are rocketing in value. Today we are going to dive into the market status of first generation A. Lange & Söhne Datograph watches, and whether or not they are seriously undervalued today.

View this post on Instagram

The A. Lange & Söhne Datograph is considered to be one of the best chronograph watches of all time, and if you have ever had the pleasure of holding one in the metal you will very likely agree with that sentiment. This notion is further bolstered by the fact that one of the G.O.A.Ts of watchmaking, Philippe Dufour, is known to have a fondness for the watch, wearing it so frequently, that one of the first generation references, the 403.031, has been nicknamed the “Dufourgraph”. While its status as a top-tier chronograph is well established within the watch community, its market value, perhaps, is a clear indicator of how this fact is yet to be appreciated more broadly. This begs the question: is the Datograph seriously undervalued?

The market analysis

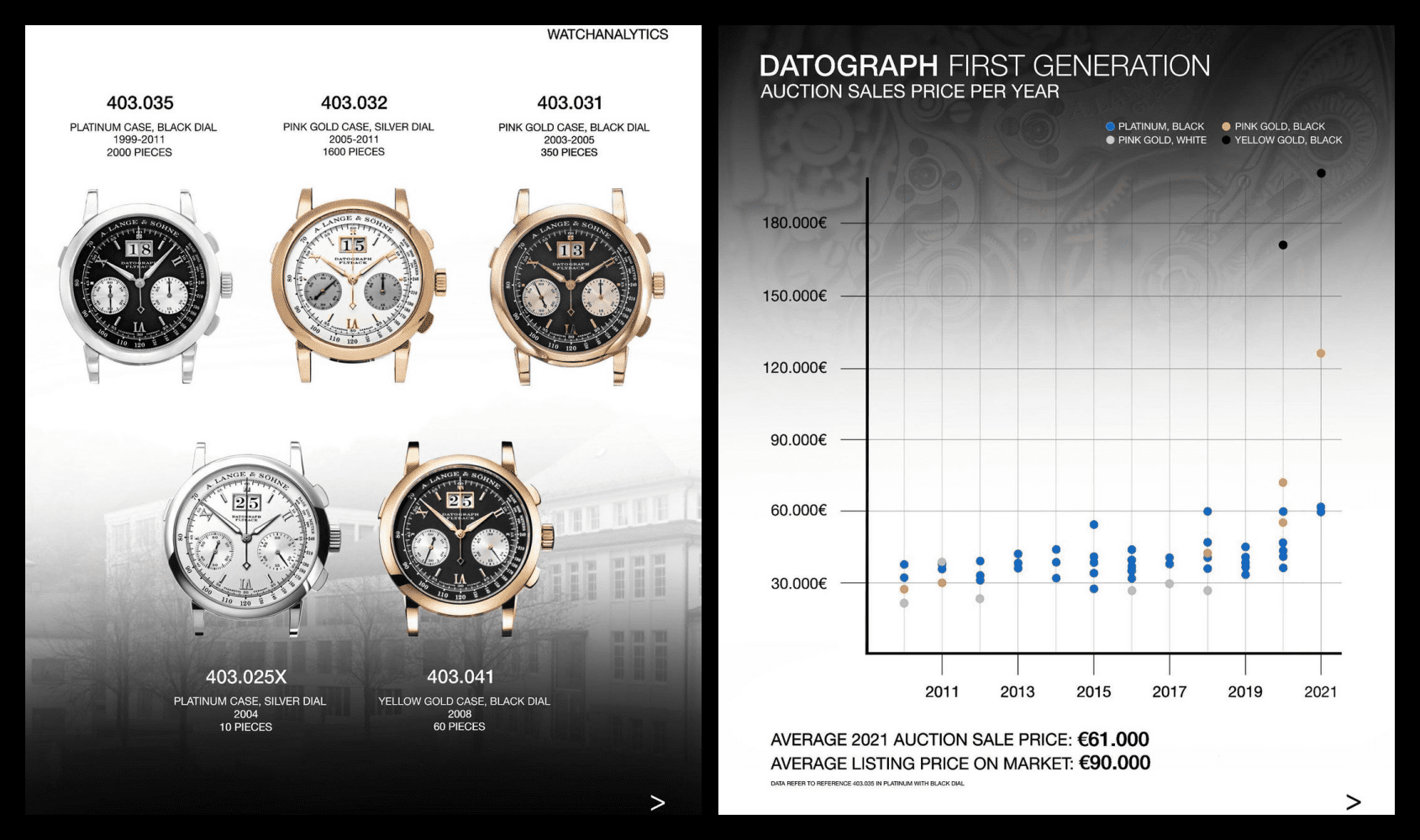

Before we dive into the numbers, it is a good idea to make sure we are all up to speed on the origins of the Datograph to market. As @watchanlytics writes: “From 1999 to 2011 this chronograph was produced in about 4000 pieces, a very limited number when compared to the 12-year period of production. Within the collection, only the platinum configuration with a black dial survived until the end; for the gold versions the productions were much more limited, in some cases even counting only two years of life.”

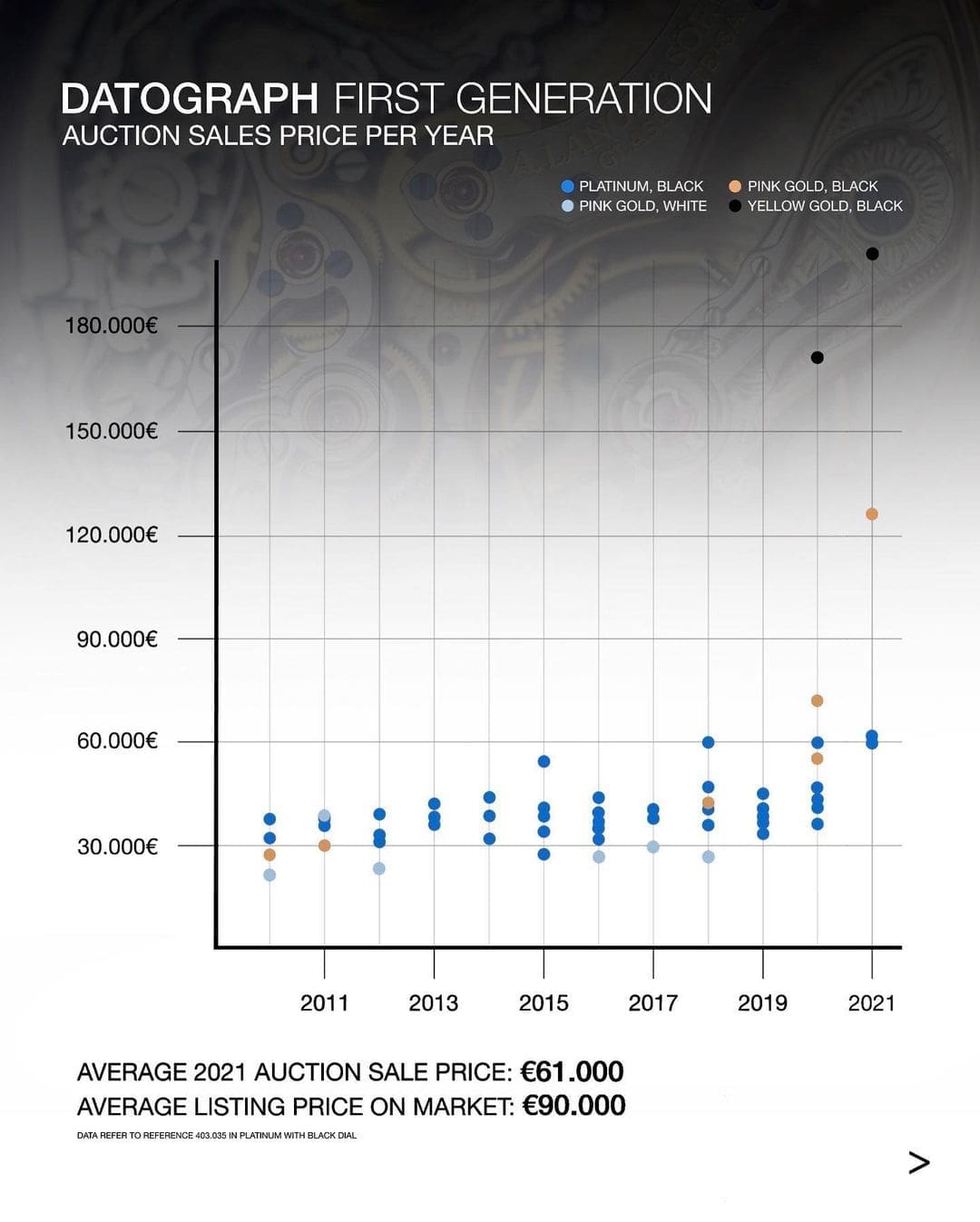

The chart above, provided by @watchanalytics, displays the auction sale results of four first-gen Datograph references from 2010 – 2021. Incredibly, while one of the most prestigious chronographs by serious enthusiasts’ standards, the hammer prices have remained stagnant from 2010 – 2019. The majority of the chart conveys the results of the 403.035 in platinum, which of the four plotted references was also produced in the greatest number – a total of 2,000 pieces made from 1999 – 2011. Therefore it is not surprising that it appeared the most at auction, but it is interesting just how much more. And remember, 2,000 watches across 12 years equates to approximately 167 watches per year. So by no means mass quantities. By 2021, the 403.035 had finally broke past €60,000, but prior to that, auction results for the reference ranged in the €30,000 – €45,000 vicinity – unbelievable value for those who won them.

The second most produced, the 403.032 had a production run of 1,600 pieces across 2005 – 2011. While 400 less were made than the platinum-cased and black-dialled 403.035, of the four it is the only reference to have multiple results beneath €30,000 (in 2010, 2012, 2016, and 2018). By being the worst-performer of the four, it is therefore the greatest value proposition of them all.

In terms of the best investment, or greatest assets, the two rarer configurations, the 403.041 (60 pieces total with a one-year run in 2008) and the 403.031 (a.k.a the “Dufourgraph”, with 350 pieces made from 2003-2005) are the strongest present performers. The 403.041, according to the data, did not come to auction until 2020 and yielded nearly €180,000 that year and approximately €200,000 the year after. The 403.031 on the other hand was sold just below €30,000 in 2010, and hit €30,000 the year after. Fast forward to 2018, it still was not that far above €30,000. But by 2020 the reference finally broke past €60,000 and nearly doubled its result in 2021 soaring past €120,000. Anyone who wanted a “Dufourgraph” prior to 2018 would have acquired one at a bargain, but now, along with the 403.041, it appears the ship has sailed on getting one for a steal.

The Takeaways

Rarity is a strong indicator of collectability and market performance. But, today watch buyers value two different kinds of rarity. The first kind of rarity, in regard to watches, is what I would describe as “true rarity”, when a watch is genuinely produced in low quantities. The second, and more plaguing kind is “rarity at retail”. This is when a watch, that is not made in ultra-rare quantities, nonetheless is almost impossible to purchase at retail. Here, @watchanalytics elaborates on this phenomena, writing in their post: “Rarity is a characteristic that today is often misunderstood and placed side by side with watches that are in great demand on the market and therefore inflated in prices. However, this term should refer to the number of existing or produced watches. If we talk about the first generation of Datograph from A. Lange & Söhne, this definition is perfectly suited.”

All of the above considered, I am definitely in agreement with @watchanalytics – the first generation of Datograph watches is a perfect case study of true rarity and its effect on market performance. But it also reveals how the watch community is a minority bubble. We have the power to influence the market, but our niche preferences are not always going to. In regards to the question @watchanalytics so aptly raised in their post, the Datograph is, in fact, seriously undervalued today in the broader marketplace. The current production models, which are now cased in a larger 41mm diameter (instead of 39mm) and include a power reserve complication, retail for €81,000 in rose gold and €95,700 in platinum (incl. VAT within Germany). Considering the average sale price of the 403.035 in 2021 was €61,000, and considerably lower in the years previous, to be able to get the watch (even if it is the older model) for 64% of the cost of the modern model is insanely good value for those interested in a Datograph watch.

On the other hand, due to their higher degree of rarity, the ref. 403.031 and 403.041 have really began to hit their stride at auction. So it is fair to say these two particular references are not undervalued. The fact the 403.041, according to the data, has only appeared at auction twice in the last 12 years, along with the fact that only 60 pieces were ever made, definitely elicited the high auction value. The 403.031 that was a 350-piece run, is less rare, but with more and more people getting into watch collecting, the credibility that Dufour gave the 403.031 may have boosted its value in the eyes of bidders.

My advice: if you are longing for a Lange Datograph in your collection, look into the platinum 403.035 or rose gold 403.032 before the marketplace wakes up to this incredible value-proposition. The fact that the average listing price for the 403.035 on the secondary market is €90,000, but its average auction result in 2021 is €61,000, shows that dealers believe this watch has greater worth that the broader marketplace has yet to catch up on.