We just found out what the year’s most hyped watch is really worth

Zach BlassAs soon as the Rolex GMT Master II 126720VNTR was unveiled at Watches & Wonders, the great destro debate ensued. Rolex thrives on incremental updates, shaving lug widths, making subtle handset changes, offering new dial colours etc. As a result, decisions such as discontinuing the 39mm Rolex Explorer, and returning a 36mm variant to solely represent the current Explorer line, are considered major changes. When you take a step out of our bubble, all Rolex has done with the new Rolex GMT Master II 126720VNTR is symmetrically flip the side of the position of the crown and date display and introduce a new black and green cerachrom bezel.

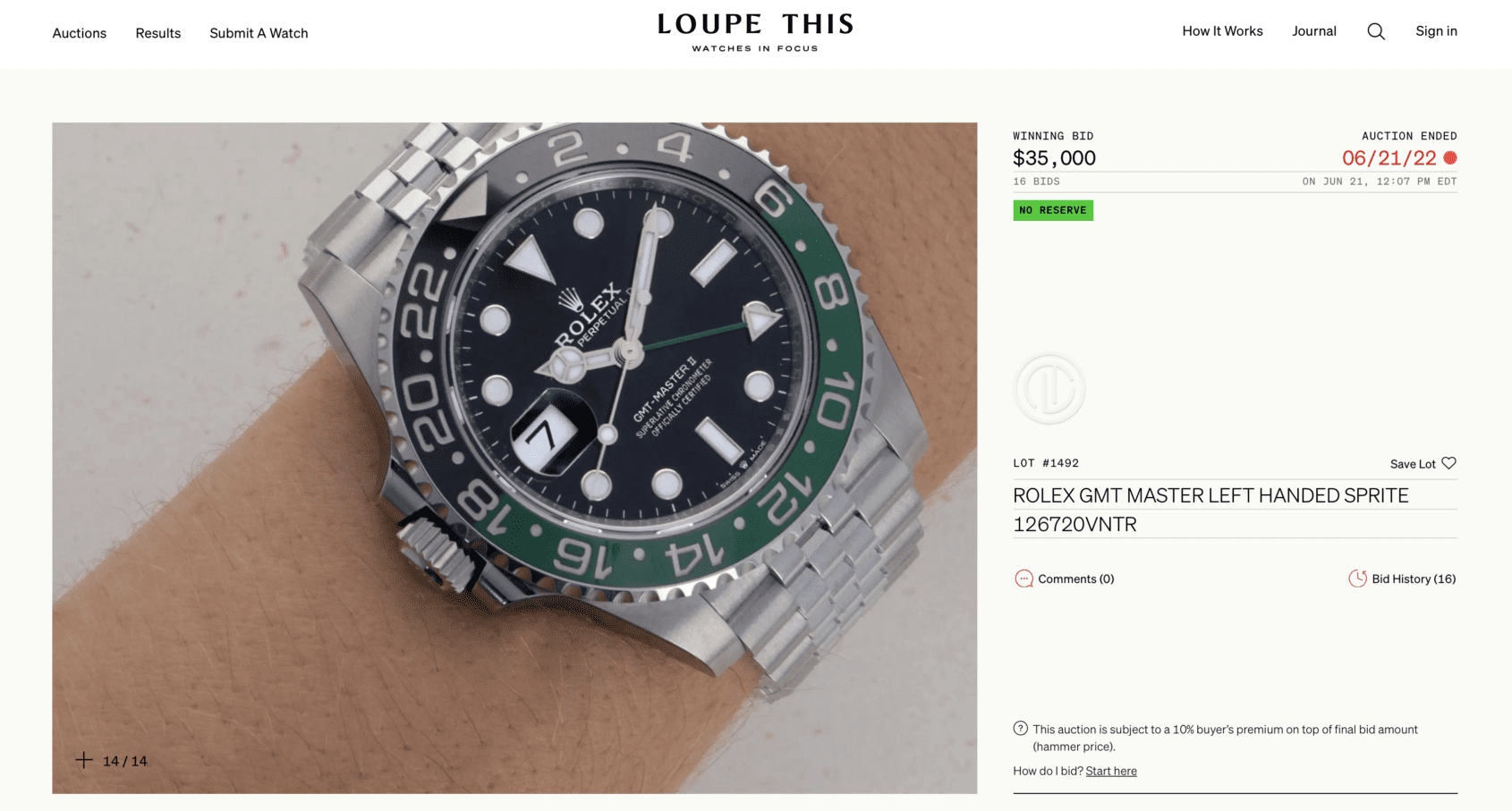

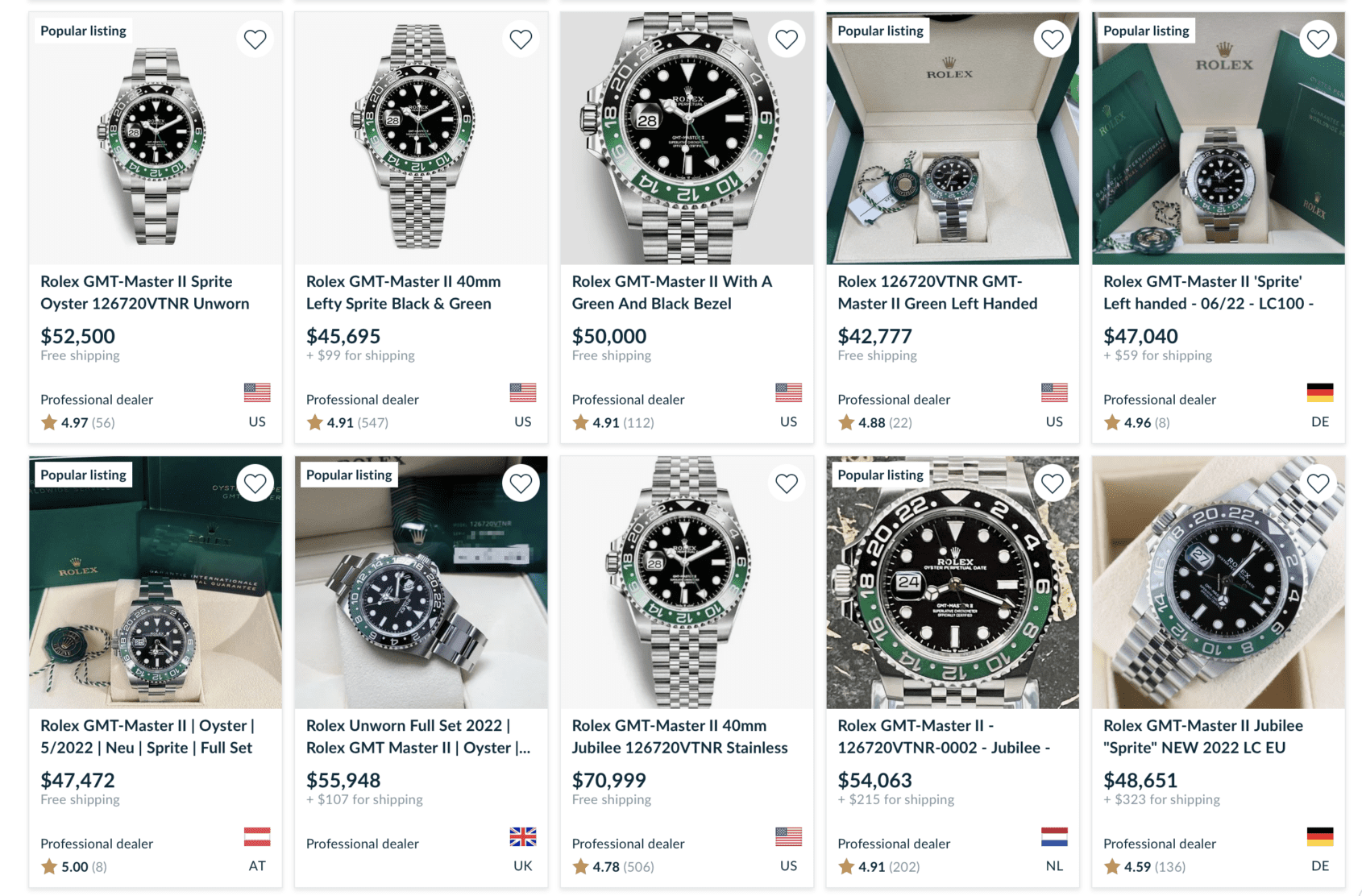

Yet, some in the watch world were enraged and confounded by the switch-up – insisting the date should remain on the 3′ side or that the flip in aesthetic made them dizzy. But these are all firsts for Rolex, and firsts, especially for a brand of this magnitude, are a huge deal to watch collectors. As expected, the watch upon its release is pure “unobtanium”. In fact, it may very well be easier to score a GMT Master II “Pepsi”. So when the first Rolex GMT Master II 126720VNTR watches began to hit platforms like Chrono24, we saw some very wild pricing – listings asking six figures for a steel Rolex sports watch. The craziness has since subsided, with listings hovering from approximately $40,000 – $80,000 USD. Today, however, we finally have a clearer sense of what the Rolex GMT Master II 126720VNTR is actually worth thanks to what appears to be the first 126720VNTR to be sold at auction. Put up for grabs at the online auction house Loupe This, lot #1492 achieved a final hammer price of $35,000 USD ($38,500 USD if you include the 10% buyer’s premium).

The platform is no stranger to setting the bar for desirable references. Just last month, Loupe This made headlines auctioning off the most expensive Cartier London Crash ever sold – raking in a final hammer price of $1,503,880 USD

“These watches are readily available in the low 40s in the dealer trade, so I thought that this result was pretty strong,” said Eric Ku, the co-founder of Loupe This. “You know $38.5K USD all in is a good result for everybody.

“The anomaly on this particular example – I guess it could be an X-factor – is that Rolex is not supposed to let their dealers sell the watches with plastic on them still and this one still had the plastic on it.”

Having this plastic, along with its warranty dating of May 2022, made this lot an exceptionally strong example to acquire. This further strengthens the idea of using the final hammer price as a benchmark of the model’s worth, albeit a pristine example.

Often collectors rely on data points found on platforms such as Chrono24, which can be an accurate barometer of value at times. But the “hype factor” of a watch can cloud the integrity of the data – especially in the earlier days of a release. Auctions though, especially ones held on such a transparent platform like Loupe This, can be a democratic declaration of what a watch is truly worth – as it is not the grey market sellers trying to set the price, the price is set by the bidder/buyer and how bad they want it.

I asked Eric whether or not auction results are ultimately the strongest determinant of value. “I definitely think it’s a better gauge of pricing in the marketplace. Chrono24, it’s not a knock on what they do, but the fact that people like to use it for data points I don’t think is a good use of their data. I think auction history is the best way to compare accurate sales data.”

Another element Eric believes strengthens the result as a barometer is the fact that Loupe This consignment fees and premiums are lower than larger auction houses. “The caveat of traditional auctions is that the all-in price realized is X,” Eric explains, “But then the consignor got paid like X – 26% or something. So a platform like ours, where the delta is very small, I think it’s a pretty good gauge for where the market is at because, for the buyer and the seller, the bridge is a lot shorter.”

The final result today on Loupe This makes it abundantly clear that there is a clear discrepancy between the amount of money secondary sellers are looking to get and what serious buyers are willing to spend. Chrono24 lists the estimated worth of the GMT Master II 126720VNTR as $47,075 USD, and, of the 59 listings currently up, only four listings are below $40,000 USD – the lowest listing carrying an asking price of $38,750 USD.

One thing that remains clear is the fact that the GMT Master II 126720VNTR is the most valuable modern GMT Master II on the market – the 126710BLRO “Pepsi” is currently hovering at a sale price around $27,000 USD. I suspect that, unless resellers have ample patience, listings for the 126720VNTR won’t move quickly unless the asking price is closer to $38,500 USD.