Is the vintage Cartier boom here to stay?

Nick KenyonWe’ve grown used to seeing jaw-dropping auction results for two brands: Rolex and Patek Philippe. But recently, the prices of one French-founded jewellery and watchmaking house have begun to climb. That’s right, Cartier is hot, with prices rising not only across the more common models, but also the top lots in auction catalogues. But what has caused the vintage Cartier market to soar?

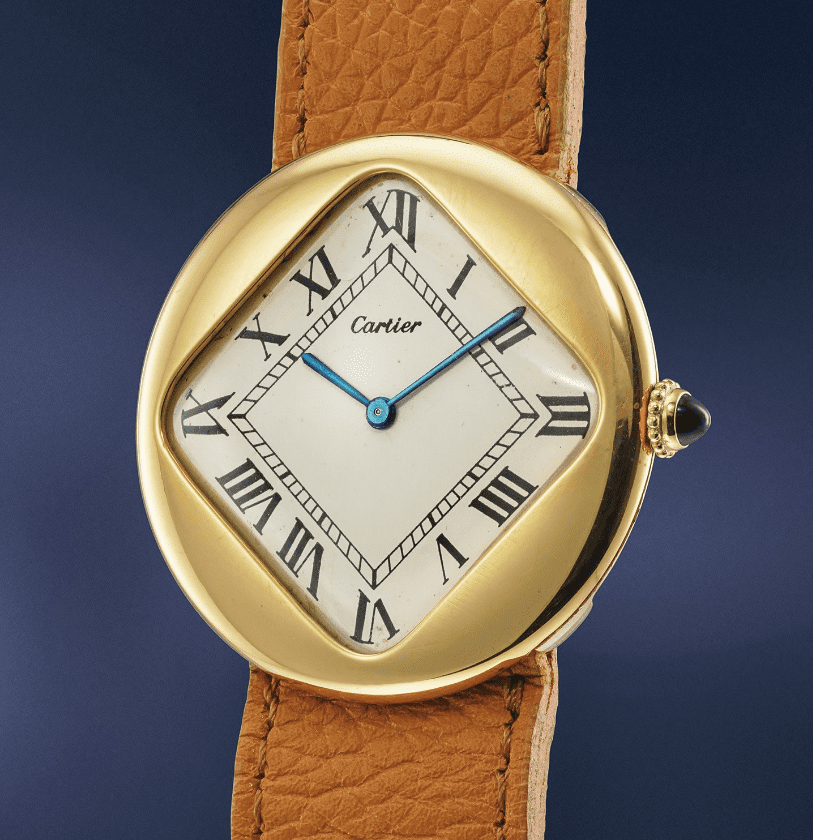

At the beginning of May, Phillips held their Geneva Watch Auction: XIII, which grabbed headlines for offering no less than four Patek Philippe Ref. 2499s in the same sale. While all of the 2499s sold well between CHF400,000 and CHF2.4M, the most surprising result was that of a diminutive yellow gold Cartier, nicknamed the Pebble in the UK and the Baseball in the US. Against an estimate of CHF50,000 – 100,000 it sold for a whopping CHF403,200, making it the most expensive vintage Cartier ever sold.

Then, at a recent Watches of Knightsbridge sale, another shapely Cartier was due to hit the block. The Cartier Octagonal would sell for £120,192, four times higher than it’s pre-sale estimate and setting another exciting high water mark for a Cartier reference. Was this result the beginning of a trend? I asked H. Vu, a well-known Cartier enthusiast with an Instagram page dedicated to his passion (find him at @13byvu) and his answer was unflinching.

“It’s an ongoing trend, for sure. Cartier is undeniably hot right now,” he explained. “I believe that this is only the beginning, as this ‘trend’ is still relatively new as we are still seeing record numbers achieved almost by the day. So yes, in my eyes it will definitely continue for some time. The rise in interest, as well as prices fetched at auctions, logically, will also lead to rare or unseen models popping up everywhere. One high result leads to many other examples showing up out of nowhere.”

This maps closely to the market reality, with another Cartier Pebble that has recently emerged up for sale at the Bonhams Fine Watches Sale in London this week. It has a pre-sale estimate of £150,000 – £200,000, which would have been a laughable amount six weeks ago at nearly double the upper estimate of Phillips. Is this simply an awakening by collectors that Cartier has been comparatively undervalued in recent years?

Yes, according to George Cramer, another leading Cartier expert and collector (@george.cramer on Instagram). “Cartier has always been undervalued over the years and it was almost normal that the auction results always lagged behind, for example, when compared with, Patek Philippe. With “Collection Privée, Cartier Paris” (CPCP), the brand has shown what their heritage is and what Cartier is capable of. Yet it took years, after CPCP had already come to an end in 2008, before the real collectors noticed the attraction of the brand, and especially of CPCP.”

Cramer believes there are a couple of factors behind this attraction. “One reason is firstly the quality, the finish and the details of the CPCP series and secondly, because many models were limited to only 100 copies. If we consider that a limited edition for brands like Omega and Panerai means that 1000 pieces have been manufactured, then a limited edition of Cartier is really something else.”

But while the quality and finish of rare Cartier models is only being discovered by the wider collecting community of late, collector Roni Madhvani (@roni_m_29 on Instagram) believes there is another factor. In general, he explained, “the essence of Cartier as a brand has always been design right from its origins. Thus it’s only natural and long overdue that this is now being recognised.”

But the key difference that we are seeing play out now Madhvani suggests is, “the increasing difficulty of obtaining fodder for the steel sports watch herd, an awakening to the beauty of design in timepieces through the rise of social media in general and Instagram in particular”.

“I don’t think the market for Cartier has matured,” he insists. “There will always be an appreciation of beauty in all material objects so if we see this as an awakening of a kind then the interest will continue. Also given that the supply itself is limited and people crave individuality as a form of expression I feel it will continue.” .

So while Rolex and Patek Philippe are unlikely to be dethroned as the rulers of the watch auction market, the appreciation for Cartier looks like being here to stay. A combination of the challenge in finding desirable vintage steel sports watches, the growing understanding of Cartier as a watchmaker and the fact that many remarkable vintage Cartier models are still relatively affordable, means that the hype around the brand is only set to grow. So if you’ve got a special Cartier in your collection, it might be worth holding onto it. Just in case you can’t afford to buy it back.