Are high-value vintage watches pandemic-proof? The auction market results from 2020 say yes…

Brendan CunninghamThis year has been remarkable in many ways. I’ve lost track of how many times I’ve said to myself, “Well, I never thought I’d see that happen in my lifetime.” Despite these surprises, the watch industry has demonstrated a remarkable stability. Sure, we lost a few trade shows. But there was also a regular flow of new releases from a wide range of brands, despite some early signs to the contrary. Equally impressive was the resilience of the auction industry. In this article, we investigate why high-value vintage watches have appeared to be pandemic-proof at a time when most segments of the wider industry are in steep decline.

Another year of broken records at watch auctions, despite broken economies everywhere

I remember watching the Phillips Geneva Watch Auction XI live stream back in May and marvelling at what they were pulling off. There were people gathered together, in person, bidding on some truly impressive lots while the pandemic was still roiling economies worldwide.

Equally impressive was the result: more than CHF 30 million in revenue, all lots sold, a world record for a Patek Philippe 1518 at CHF 3.4 million, and a pair of F.P. Journe early references sold for CHF 2.4 million. The pattern has continued, with two Dufour Simplicity watches recently selling at Sotheby’s in Hong Kong for a combined total of more than $US 1 million. A Rolex Daytona Paul Newman ref. 6264 “John Player Special” set a record for the most expensive watch sold at a UK auction earlier this summer when the hammer dropped at about $1.5 million.

The auction houses are forging ahead with plans to continue these remarkable achievements as we head into one immovable event: the holiday season. It is reasonable to ask if we are witnessing some kind of irrational speculative bubble in luxury watch pricing that might soon pop. After all, how can the watch industry still thrive when the economies of the G20 shrank by 6.9 per cent in the most recent quarter? The answer lies in the fallacy of division. What is true of the whole is not necessarily true for all of the parts.

Why are high-value vintage watches the exception to the recession rule?

There are certain forms of leisure that are not compatible with present circumstances. Conditions vary from place to place, but it is fair to say that travel, dining out, sports events, and live entertainment are compromised, or perhaps simply not an option, for most people. If your life involves budgeting for these activities, and you are fortunate enough to still have a reliable source of income, then your leisure “account” actually has a positive balance burning a hole in your wallet.

Watch buying is a natural outlet. There is ample opportunity to learn about and consider products online. They can be easily mailed and you can enjoy them even when you are working from home. Live-streamed auctions might plausibly serve as an entertaining substitute for live sports (the auction houses are reporting ever-growing numbers of registered online bidders). On Instagram and other platforms, there is even a social dimension to having a new timepiece. These factors are undoubtedly part of the surprising recent success of modern and vintage sales at auction and otherwise.

The ‘flight to liquidity’ factor is absolutely huge

The watch industry has also benefitted from a phenomenon we economists sometimes refer to as a “flight to liquidity”. During a recession or depression, many asset prices decline. In particular, equities (stocks) and real estate tend to lose value or stagnate. In order to counter this risk, individuals typically move their savings into alternative “safe harbours” exhibiting high liquidity. In the midst of the 2013-16 economic period, the median Australian household held $3 in cash for every $1 in stocks. In 2018, during an expansion, the median Australian household did just the opposite, holding almost $2 stock for every $1 in cash.

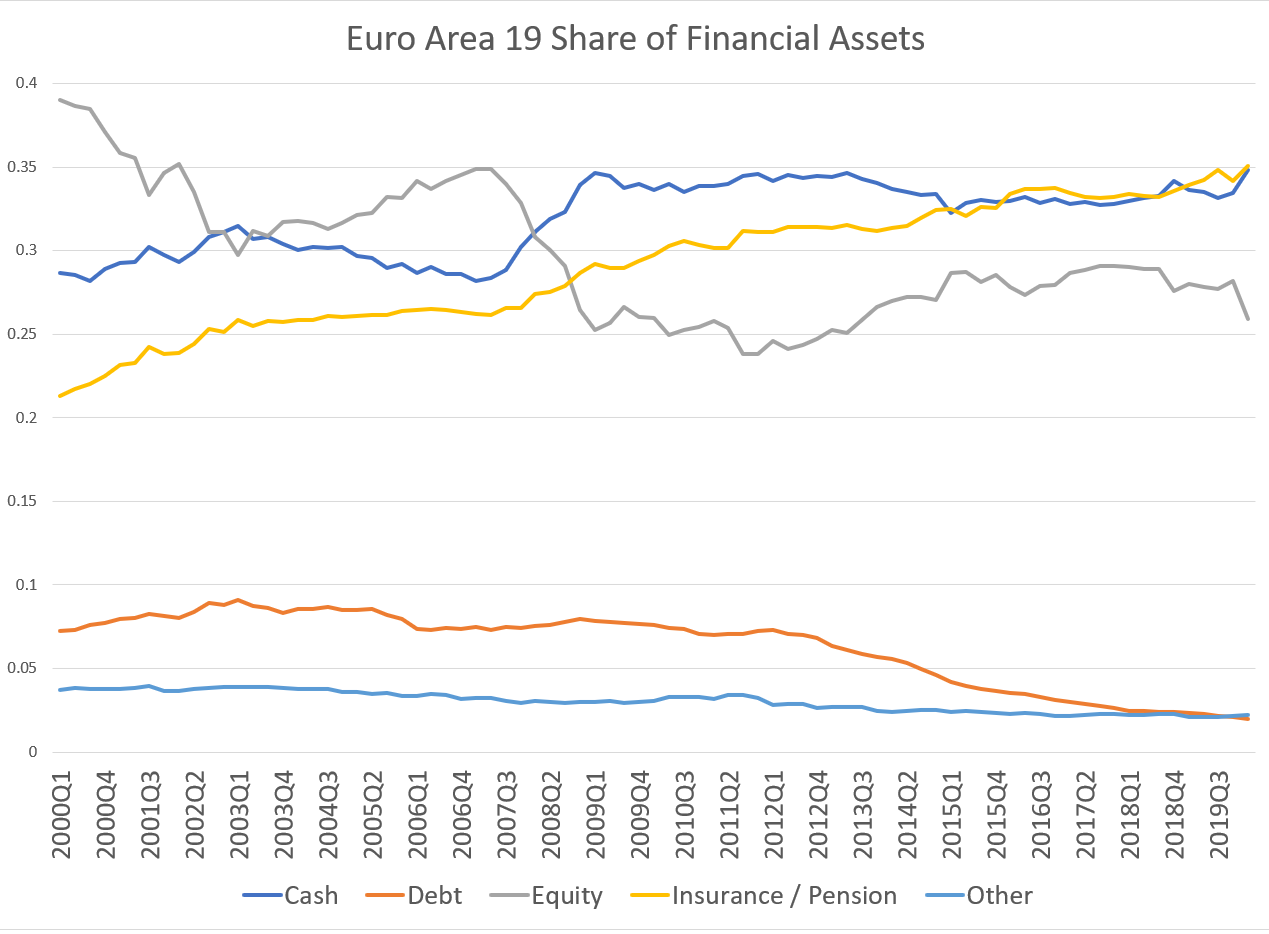

We can see the same pattern in Europe and the United States. The first figure below shows, quite starkly, the role reversal of equity and cash amidst the late-aughts financial crisis. Pre-crisis the largest portion of savings was equity, post-crisis it was cash.

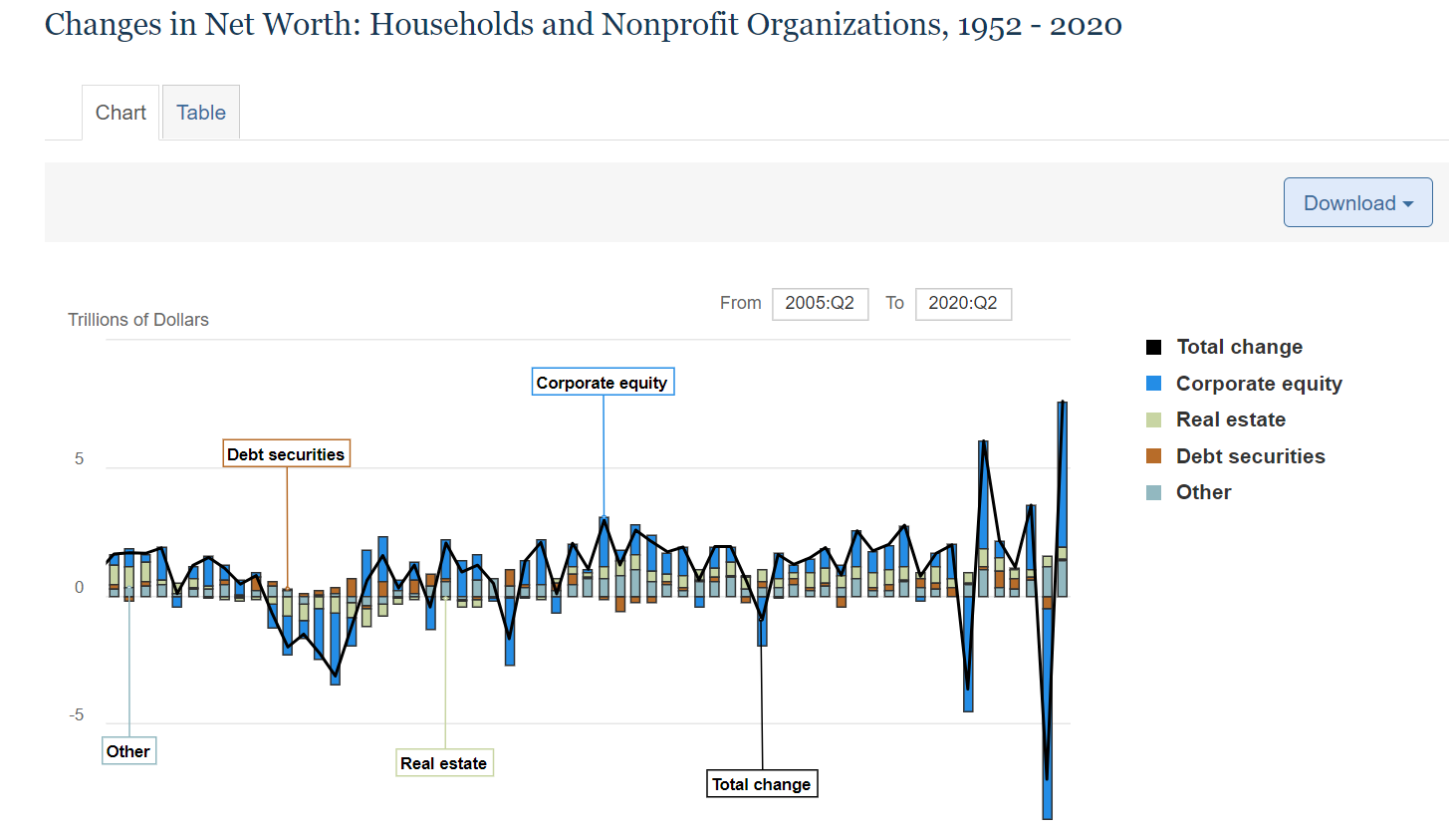

The second figure shows a similar pattern more recently in the United States, where “other” assets, such as cash, stood at approximately $US 600 billion at the end of 2019. Post-pandemic that balance more than doubled to $US 1.36 trillion.

What does this flight have to do with the watch industry?

What does this near-universal flight to liquidity have to do with the watch industry? A lot, actually. There is an ongoing debate about whether or not one should view watches as an investment. I prefer not to even enter that debate and simply state a fact: watches are an asset. They hold value over time. That value can increase or decrease depending upon a wide array of considerations. Like any asset, watches carry risk.

What are the liquidity properties of watches? The truth is that watches are a very, very liquid asset class. You can move them around, physically, very easily. You can use them as collateral for rapid short-term borrowing. Sales of well-established brands with traditional designs can be completed fairly rapidly. Consequently, it is reasonable to postulate that at least part of this year’s robustness in auction outcomes, and watch sales more generally, can be attributed to the overall flight to liquidity taking place during the pandemic.

The good news

The good news for collectors is that, as the world returns to a more normal economic footing, the watch industry may very well continue to thrive. There is nothing better for luxury watch sales than large numbers of potential buyers receiving a healthy bonus at the end of a stellar quarter. Other sources of sales, such as watch purchases during travel, are likely to return to baseline or better. Having admirably weathered the most challenging economic crisis in more than half a century, the watch industry will no doubt celebrate the inevitable return to a more healthy economic environment.