Rolex launch certified pre-owned program, but we are left with more questions than answers

Zach BlassThe pre-owned market for watches has become bigger and bigger each year – so much so that resale giants like eBay have doubled down and entered the mix, while a company like WatchBox can afford to sign Michael Jordan (yep, the basketball GOAT) as an ambassador. Recently, we have seen brands like Richard Mille do their own certified pre-owned programs themselves. But the community was most eager for Rolex to enter the fold. Today, Rolex has finally acknowledged the significance of the pre-owned marketplace, launching their own certified pre-owned program. But amidst all the excitement around this revelation, we are left wondering what this will really change? Will this have the impact enthusiasts around the world are looking for?

Dissecting what we know

The Rolex press release on the new certified pre-owned touches on a few points, so I will run through the highlights and my personal analysis.

“Rolex Certified Pre-Owned watches will initially be available at Bucherer boutiques in six countries (Switzerland, Austria, Germany, France, Denmark and the UK) from the start of December 2022. Other Official Rolex Retailers who choose to be part of this programme will be able to do so from spring 2023.”

The program is clearly being rolled out carefully, so we will not see an immediate impact, if any, to how the secondary market behaves. With only six countries participating, none of which are the largest markets – the USA and China – Rolex is clearly testing the program closer to home first, and will hopefully work out any kinks in the system before expanding it to the rest of the world in spring 2023. A smart move, allowing them to beta test the program in a way.

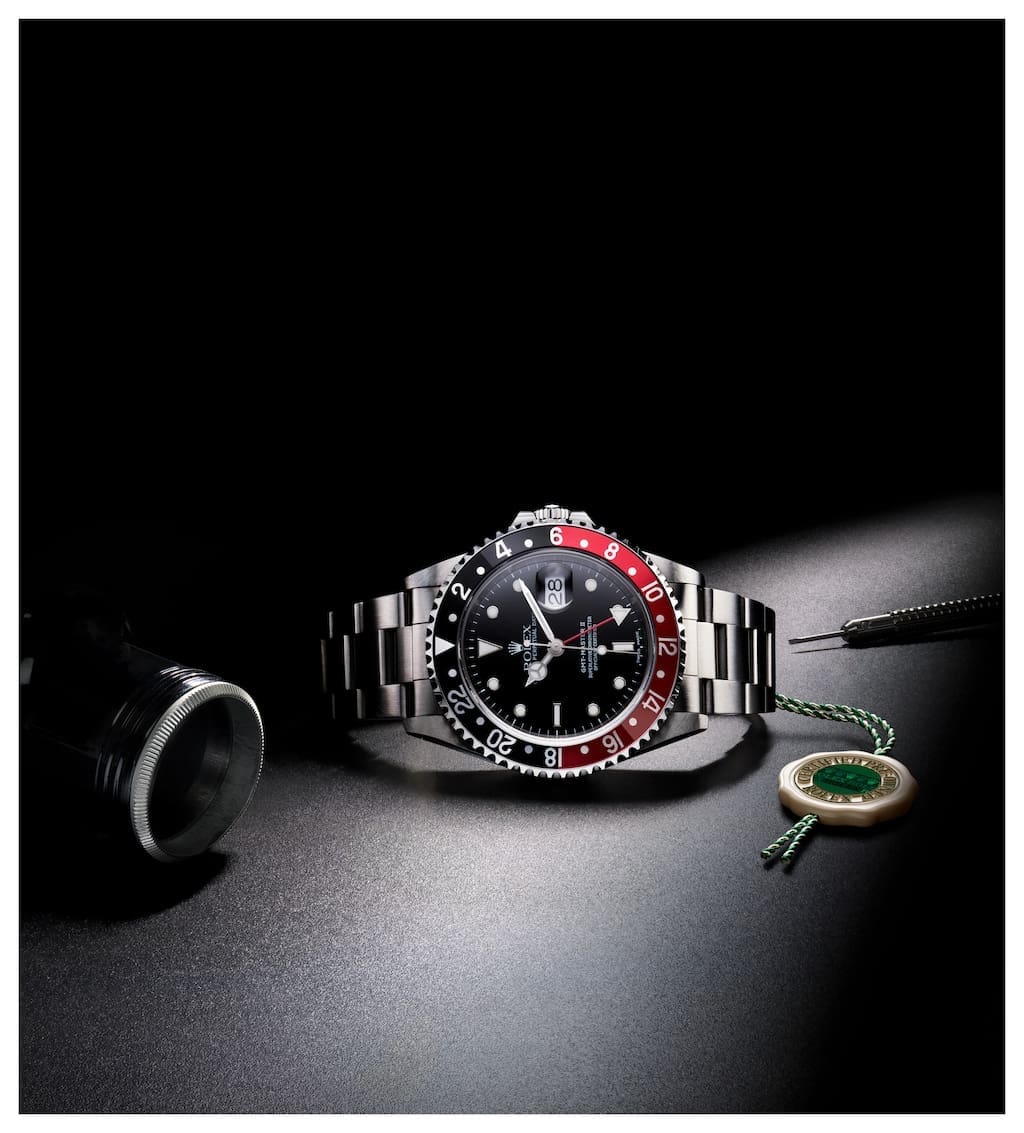

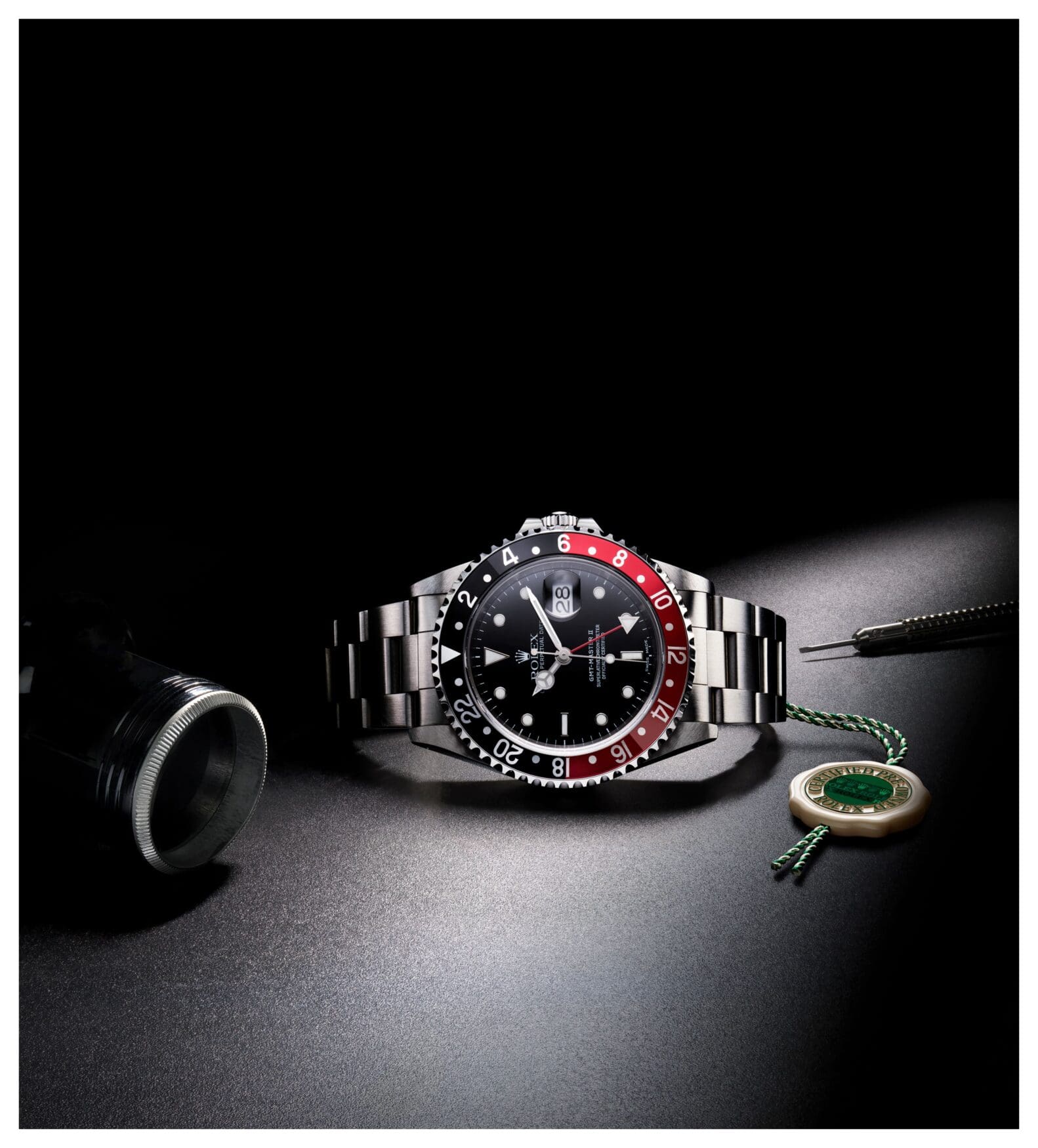

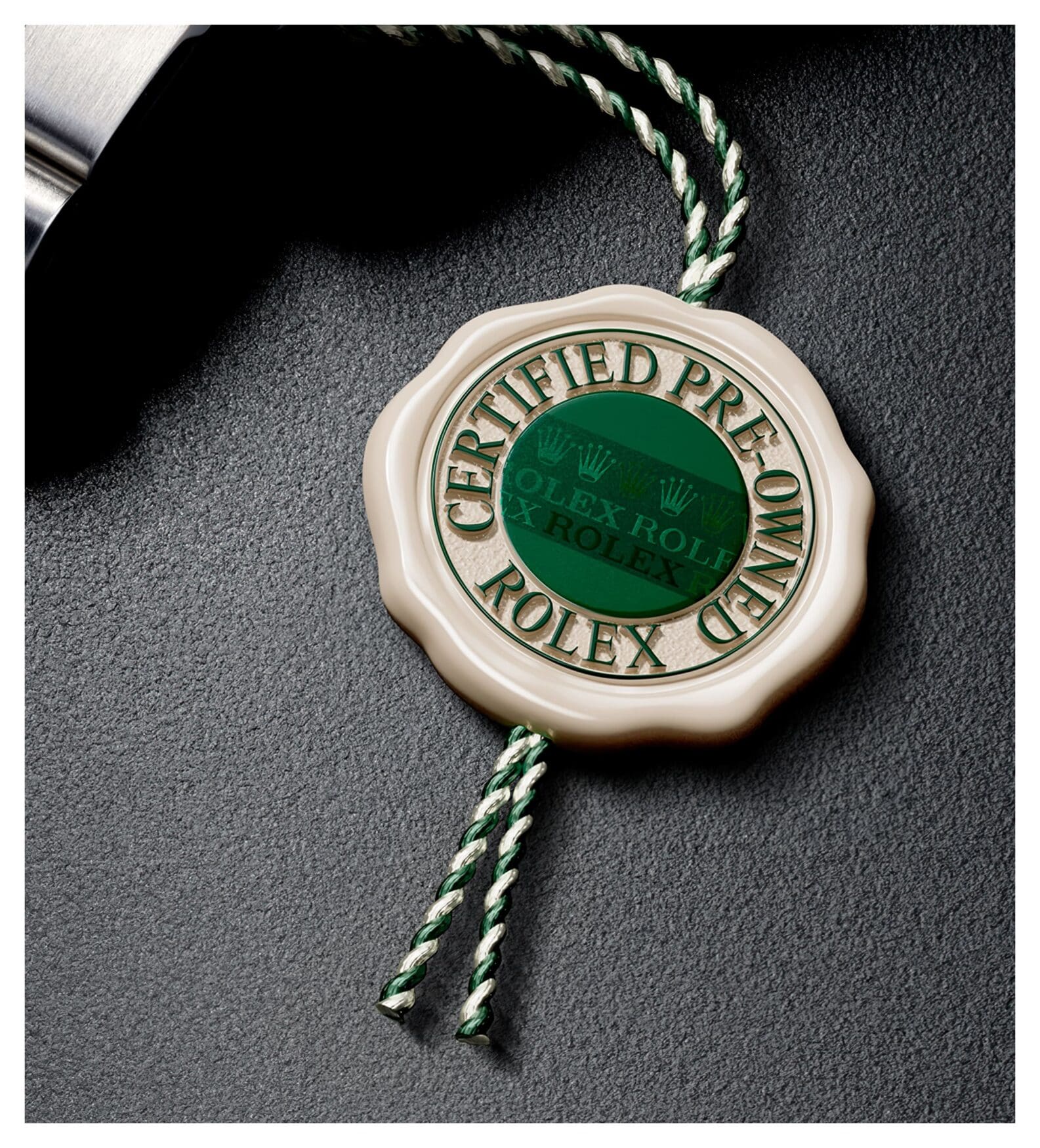

“In concrete terms, the Rolex Certified Pre-Owned programme attests the authenticity of second-hand Rolex watches – that are least three years old – at their time of resale by an Official Retailer displaying the special Rolex Certified Pre-Owned plaque. It guarantees that these watches benefit from the quality criteria inherent to all Rolex products and from the full know-how and professionalism of the brand’s worldwide network of experts.”

Rolex, at least within their own program, is clearly making an effort to curtail flipping, only allowing watches that are at least three years old to enter their certified network of pre-owned inventory. Watches purchased through the program will have the advantage of being personally backed through the manufacture, with a Rolex two-year international warranty, offering consumers the utmost confidence in the authenticity and performance of the timepiece.

“These certified-authentic second-hand watches also offer customers a tangible and immediate opportunity to become part of the world of Rolex.”

Arguably the most interesting statement within the press release, its inclusion is seemingly a public nod Rolex is aware of the unobtanium nature of many of their references. Perhaps a leading motivation for Rolex to enter the pre-owned market, aside from the potential revenue opportunities, is that they believe this program is an answer to the woes of their consumers regarding product availability. By opening a pre-owned channel, it seems Rolex believe they can generate more opportunity for buyers to access in-demand pieces within their network of authorised dealers.

Pondering what we don’t know

While Rolex has answered some of our questions upon their announcement, there are still plenty more questions to be answered.

How does Rolex really benefit from this program?

How does Rolex really benefit from this program?

Rolex watches are sold through a network of authorised dealers, they do not have complete ownership of their points of sale. Rolex makes their money selling their watches to their authorised dealers, who then sell the watches at retail pricing for profit. So, I am left wondering how does Rolex profit from this program? If the authorised dealers are the ones purchasing back inventory, and then reselling the pieces once formally certified, are all of the proceeds of the secondary sale going to the retailers themselves? A revenue share with Rolex? My personal inference is that the authorised dealers will take the full proceeds of the sales, but that they will have to compensate Rolex for their time refurbishing and certifying the watches. I also assume Rolex will play a role, or provide guidance in, the pricing of the timepieces as well as the price that authorised dealers will pay to purchase pre-owned inventory.

If only watches three years or older can enter the Rolex certified pre-owned program, won’t the more in-demand references still be largely sold outside the program?

The three-year moratorium definitely curtails flipping, but it does not put a stop to flipping by any means. This means Rolex is playing a fair game, but it does not mean the larger spectrum of Rolex resellers will not fight dirty. Sure, there are plenty of people who have owned hot Rolex watches like the ceramic Daytona or ceramic Pepsi and Batman GMT Master II for over three years. But unless the certified pre-owned program is willing to pay top-dollar for the watches, these pieces will not enter the program with enough frequency to provide the instantaneous access Rolex refers to in their press release. And if Rolex ADs purchase back Rolex watches at higher cost, then these certified pre-owned pieces may not be able to be competitively priced – they will simply have the advantage of a Rolex guarantee. Yes, the Rolex-backed gaurantee offers 100% confidence in authenticity. But in terms of “buying the seller”, there are definitely plenty of grey dealers outside the scope of the eventual network of Rolex certified pre-owned program that buyers can safely do business with. Plus they do not have the roadblock of having to wait three years before purchasing a Rolex back.

What will the pricing structure look like? Will Rolex certified pre-owned watches be sold at market price? Above? Below?

As I mentioned before, yes, the Rolex-backed guarantee gives a certain confidence edge for program participating authorised dealers. But the ultimate deciding factor is the pricing. Authorised dealers like Bucherer already have their own dealer-certified pre-owned programs, and have offered Rolex watches pre-owned at high-market pricing with sizable margins over the price they paid to purchase the Rolex back. Ultimately, if the pot is not sweet enough for current Rolex owners to sell their watches to authorised dealers, and the resale pricing is not competitive enough to entice buyers, then the 100% certainty of authenticity and condition is really the only edge the program offers. But in terms of condition, there is another issue.

How will Rolex handle vintage pieces?

A marquee element of the program Rolex is advertising is the fact that the certified pre-owned watches are 100% authenticated and that they will be serviced up to Rolex’s superlatively high standards. But, as we all know too well, sometimes Rolex is accused of over-servicing timepieces to bring them up to their level of specifications. This is not so much of an issue for more modern watches, but with vintage this is a major point of discussion. Collector-grade condition demands coveted vintage references remain in untouched original condition, with cases, dials, and handsets not refinished. To ensure the watches can be backed by the two-year international warranty Rolex is offering for their certified pre-owned watches, however, Rolex has not addressed whether or not they will be swapping out original parts for service parts in the process. Historically, Rolex has disregarded this desire of consumers – polishing cases or replacing original parts with service parts under the umbrella of ensuring the watch meets the performance standards of the brand. That being said, I doubt collectors will be bringing their Paul Newman Daytonas to Rolex to resell. That calibre of vintage pieces will likely still make their way to auction houses like Phillips, Sotheby’s, and Christie’s.

Final thoughts

Ultimately, I do not really see the gamechanging effect this program will have. It seems more symbolic than impactful, at least for now as we wait to see how the program grows, evolves, and operates. The program is all about offering certainty and quality in the Rolex pre-owned space, but there is still much uncertainty shrouding the program. How Rolex navigates pricing, addresses vintage pieces, and whether the three-year rule completely inhibits Rolex from containing flipping on a large scale remains to be seen. It is just too early to tell, but we will all certainly be following the progress of the program in the coming months and years.

UPDATE: We have our first example of what pricing looks like under the program courtesy of WatchPro.

How does Rolex really benefit from this program?

How does Rolex really benefit from this program?