Record auction prices, crazy hype, growing waiting lists… Are luxury watches becoming more popular? An economics professor crunches the numbers

Brendan CunninghamEditor’s note: Brendan Cunningham is a Professor of Economics at Eastern Connecticut State University and the man behind Horolonomics, a blog that explores the economic issues in watchmaking.

Are watches really gaining in popularity? The answer may seem obvious. Auction houses and certain watch designs are setting all kinds of records. Wait lists for hype timepieces stretch years into the future.

It is challenging to gauge the real significance of these developments. The potential market for luxury timepieces is immense. According to Credit Suisse’s recent report on global wealth, there were 56 million millionaires worldwide in 2020. The number of millionaires exceeded the population of Spain by roughly 10 million people. This implies that Swiss exports of 13.8 million watches is not necessarily all that remarkable. More than 75% of the world’s millionaires did not buy a new Swiss watch in 2020. Much of the global market for luxury watches remains untapped.

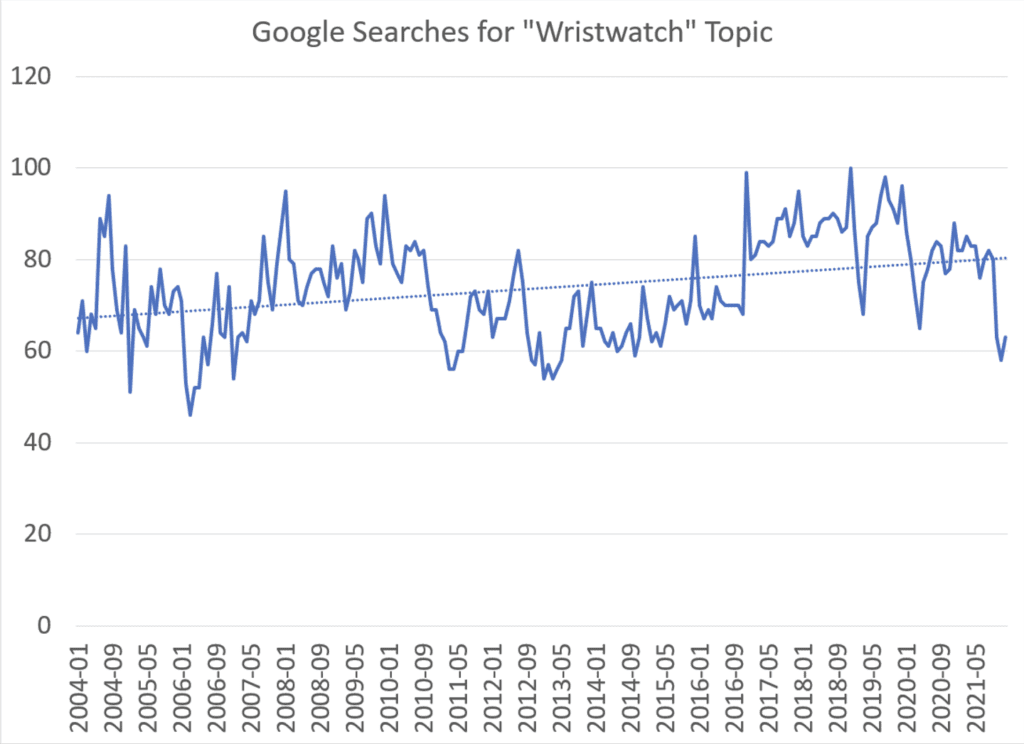

It is certainly true that enthusiasm for watches has been on the upswing. Google Trends data indicates that since 2004, the wristwatch, as a search topic, has gained interest year in and year out. Interest was particularly strong in recent years. Between 2016 and the beginning of 2020, Google search interest regularly exceeded historical norms. However, during the pandemic, interest in the topic has slightly receded. It remains to be seen if this lull will continue.

We can gain still more insight into the state of the luxury watch market thanks to statistical agencies worldwide. In order to measure inflation, these agencies devote significant resources towards understanding the spending patterns of consumers. Some agencies collect detailed statistics on niche markets, such as spending on watches and clocks, and report what they learn within the context of general spending by consumers. Let’s turn to this data to learn some things about the state of the watch market.

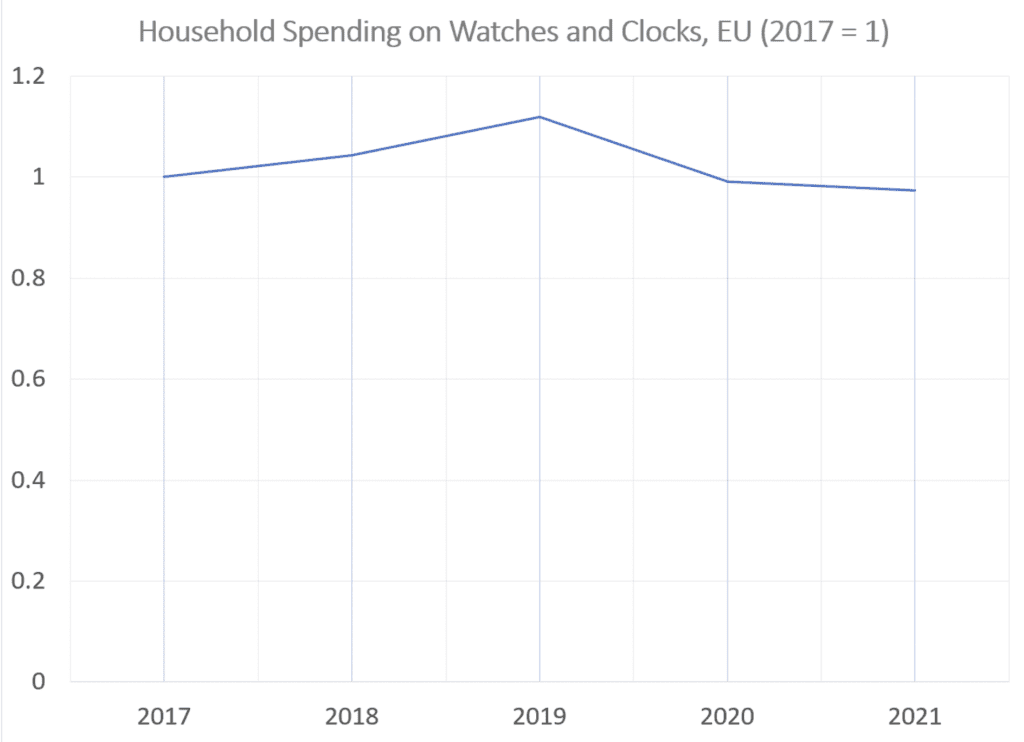

The European Union has, by far, the most comprehensive and accessible data on purchases of watches and clocks as a share of total consumer spending. In the EU, consumers typically spend more of their budget on bread than they do on watches and clocks. Baguettes and focaccia are about 10 times more important than watches and clocks for the typical European consumer. In addition, the portion of European spending allocated to watches and clocks has not trended upward or downward over the past five years. Watch and clock spending is particularly strong in Italy and Portugal, whose consumers spend approximately twice and thrice the European average, respectively.

Portugal has also witnessed the largest surge in spending on watches and clocks. In 2021, the typical consumer more than doubled the portion of their spending allocated to timekeeping devices. There is more than a little irony in the fact that Switzerland saw the largest drop in the portion of consumer spending allocated to watches and clocks. It fell by almost 50%.

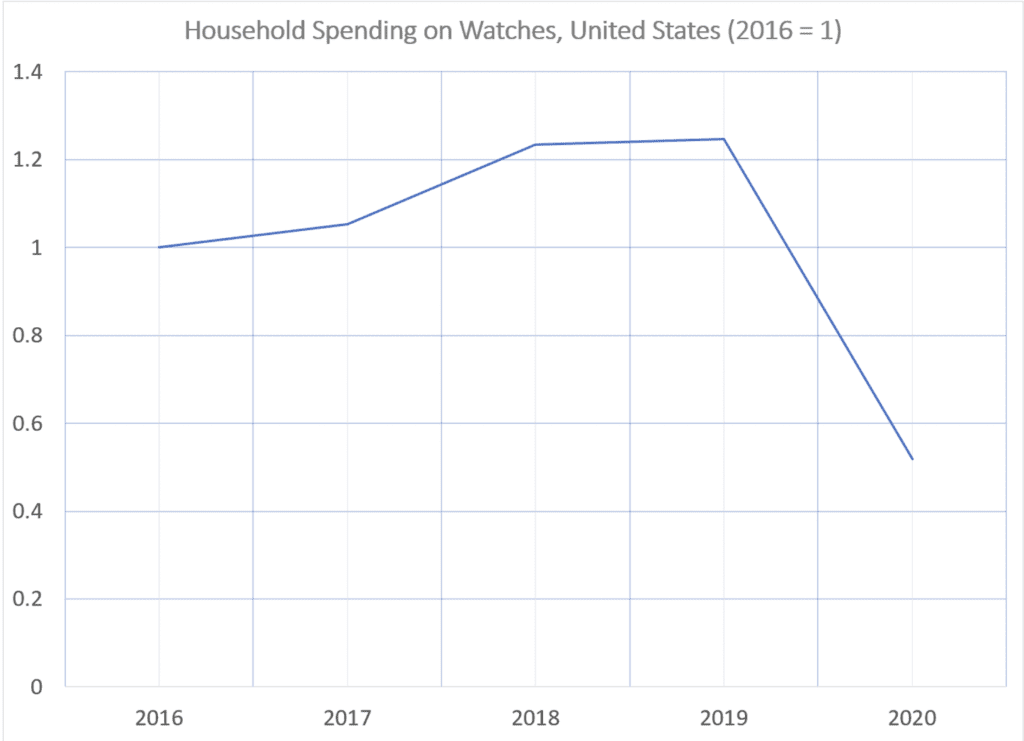

It is challenging to find this kind of information for all countries, in most cases you’d need to submit a query to a statistical agency and hope they’d be willing to provide what you’re asking for (I believe this may be the case for Australia). The United States is one country that offers data that is comparable to Europe. It shows a similar pattern, with one important exception. Spending on watches in the United States is also very modest for the typical household. It is roughly equivalent to the amount spent on flour for baking. Between 2016 and 2019, there was an annual increase in the portion of an American’s budget set aside for watches. However, in 2020, during some of the earliest and darkest months of the pandemic, there was a noticeable decline in this allocation. It remains to be seen if the data will show a rebound in 2021.

Data from national statistical agencies provide a nuanced story about the state of demand in the watch industry. It is true that interest in watches has intensified in recent years, at least in two markets offering detailed statistics. However, demand seems to have softened through the pandemic. Further, there is a lot of room for the watch industry to grow. Among the population of those with the greatest resources worldwide, data suggests that far less than half buy a luxury watch in a particular year. Moreover, the typical household really does not spend very much on watches or timekeepers as a portion of their overall budgets.

In some ways, there is reassurance in knowing that there are ample opportunities to expand the market for precision watches. Since the industry has managed to do so in the recent past, there are many reasons to believe that we will see such an expansion in the near future.