Michael Jordan invests to lift WatchBox valuation to almost $1 billion

Luke BenedictusMichael Jordan famously said that “you miss 100% of the shots you don’t take”. But the risk/reward ratio on his latest investment looks promising. The basketball legend joined a list of athletes to invest in WatchBox, the trading site, which bills itself as “the world’s leading e-commerce platform to buy, sell, and trade luxury watches”.

Yesterday Watchbox said that it raised $165 million USD in its latest round of financing. Other sporting investors alongside Jordan were Milwaukee Bucks MVP Giannis Antetokounmpo, Bucks owner Marc Lasry, Phoenix Suns stars Chris Paul and Devin Booker, plus NFL stars Michael Strahan and Larry Fitzgerald.

Founded in 2017, WatchBox has already surpassed $1 billion USD in total revenue. The company said it will use the latest injection of capital to bolster its digital platform and expand into new locations in the United States and internationally while also improving its inventory.

“WatchBox’s sales are up 40% year over year and we are on target to achieve $300 million in sales this year,” co-founder and CEO Justin Reis told Reuters.

“Rolex, Patek Philippe, Audemars Piguet, and A. Lange & Sohne continue to perform incredibly well alongside leading independent brands”

Based in the US, Watchbox has attracted $260 million USD of investment since its founding in 2017. While the company did not disclose its latest valuation, a source told CNBC that it’s now approaching $1 billion USD. Reis also told CNBC this week that the company could seek an IPO in the future.

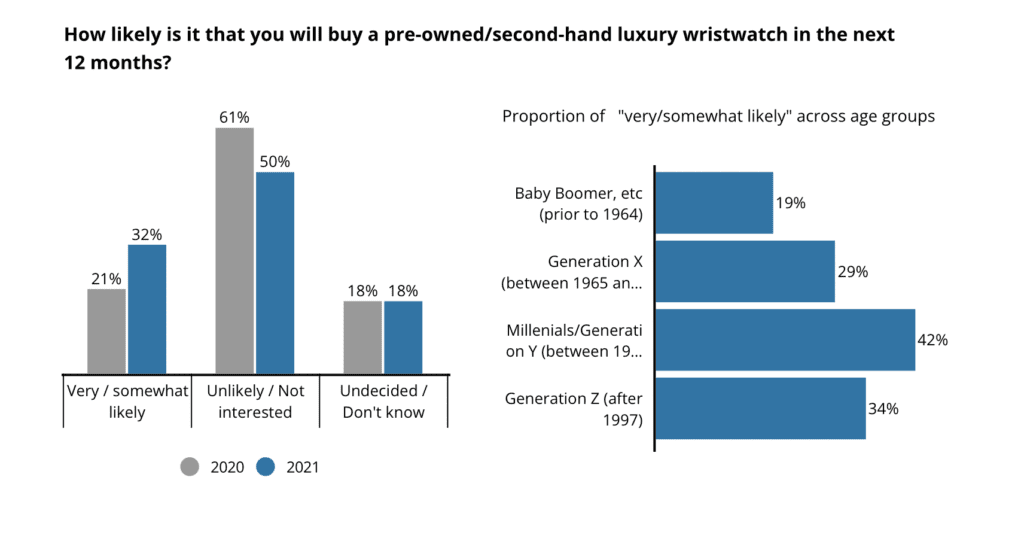

It’s another sign that, right now, preowned watches are hotter than ever. Earlier this year, The Deloitte Swiss Watch Industry Study 2021 surveyed 5,558 consumers from all over the world and found that almost one in three (32%) said that they were “very likely” or “somewhat likely” to buy a second-hand watch in the next 12 months. That response amounts to an increase of almost 50% from last year’s survey.

This rocketing trend was also backed this year by a McKinsey’s report that predicted the pre-owned market will expand by up to 10 per cent per year between 2019 and 2025, reaching annual sales of $29 to $32 billion. In comparison, McKinsey’s believes when it comes to new watches, the premium to ultra-luxury category will grow by just 1 to 3 per cent a year during the same period.

WatchBox is not the only company trying to cash in on this growing demand. Rivals like Watchfinder, Watchmaster, and Hodinkee are also expanding and jostling for positioning in the secondary market. Hodinkee raised $40 million last December with investors including NFL quarterback Tom Brady. Now Watchbox have acquired their own sporting icon investor in the form of Jordan, a name that will presumably bring extra momentum and exposure to the company’s efforts to grow.